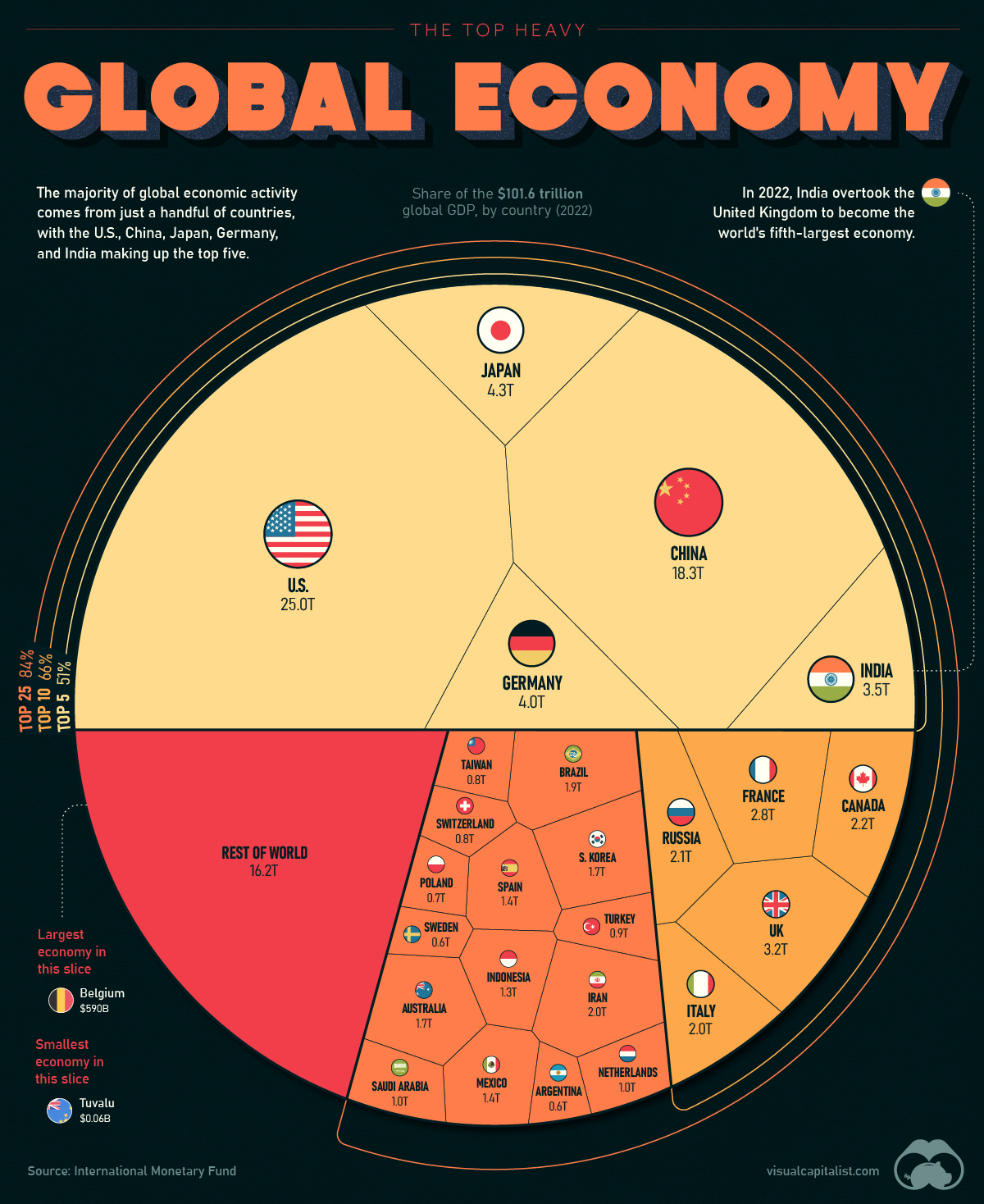

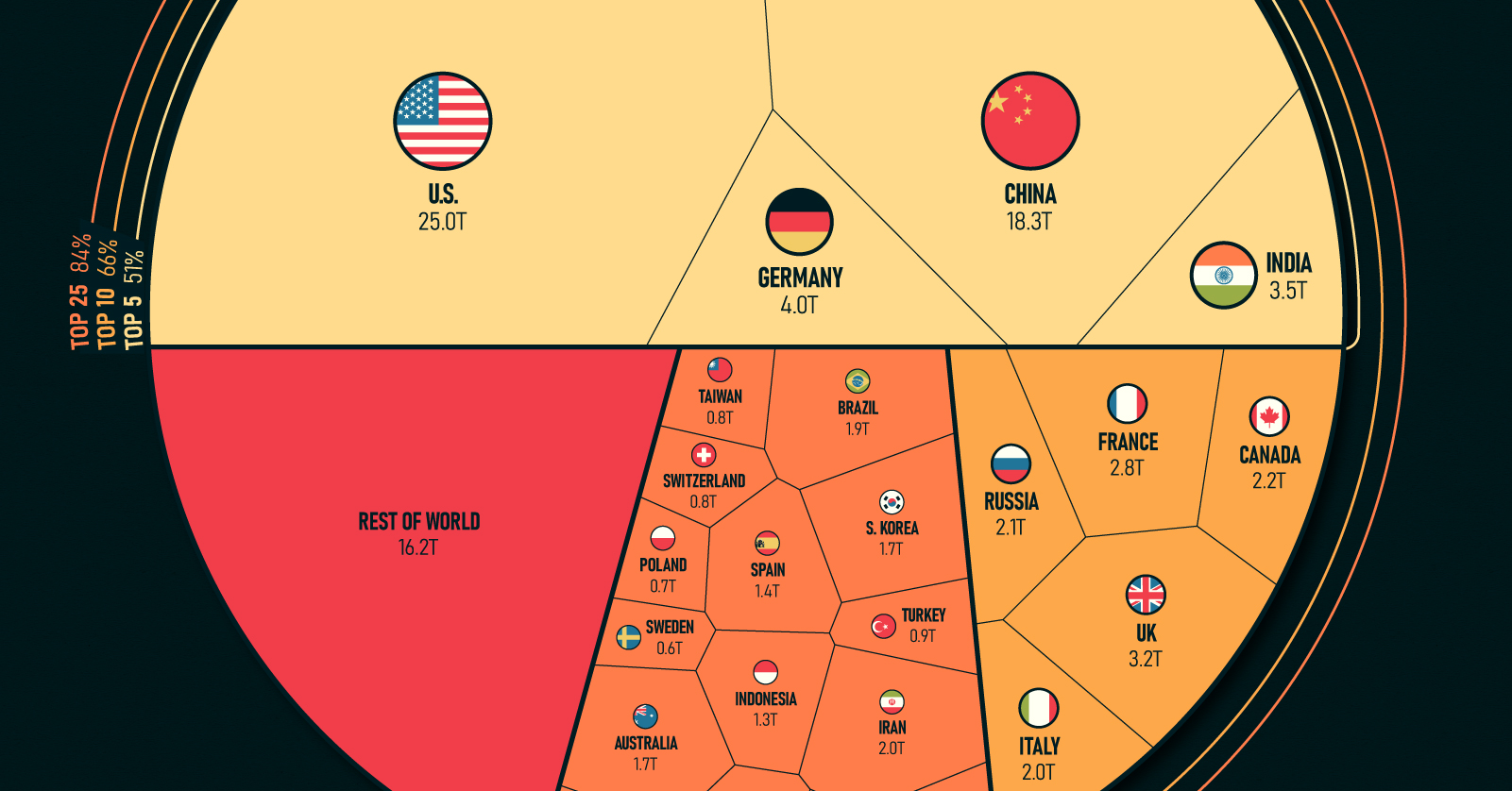

Countries by Share of the Global Economy

As 2022 comes to a close we can recap many historic milestones of the year, like the Earth’s population hitting 8 billion and the global economy surpassing $100 trillion.

In this chart, we visualize the world’s GDP using data from the IMF, showcasing the biggest economies and the share of global economic activity that they make up.

ℹ️ Gross Domestic Product (GDP) is a broad indicator of the economic activity within a country. It measures the total value of economic output—goods and services—produced within a given time frame by both the private and public sectors.

The GDP Heavyweights

The global economy can be thought of as a pie, with the size of each slice representing the share of global GDP contributed by each country. Currently, the largest slices of the pie are held by the United States, China, Japan, Germany, and India, which together account for more than half of global GDP.

Here’s a look at every country’s share of the world’s $101.6 trillion economy:

| Rank | Country | GDP (Billions, USD) |

|---|---|---|

| #1 | 🇺🇸 United States | $25,035.2 |

| #2 | 🇨🇳 China | $18,321.2 |

| #3 | 🇯🇵 Japan | $4,300.6 |

| #4 | 🇩🇪 Germany | $4,031.1 |

| #5 | 🇮🇳 India | $3,468.6 |

| #6 | 🇬🇧 United Kingdom | $3,198.5 |

| #7 | 🇫🇷 France | $2,778.1 |

| #8 | 🇨🇦 Canada | $2,200.4 |

| #9 | 🇷🇺 Russia | $2,133.1 |

| #10 | 🇮🇹 Italy | $1,997.0 |

| #11 | 🇮🇷 Iran | $1,973.7 |

| #12 | 🇧🇷 Brazil | $1,894.7 |

| #13 | 🇰🇷 South Korea | $1,734.2 |

| #14 | 🇦🇺 Australia | $1,724.8 |

| #15 | 🇲🇽 Mexico | $1,424.5 |

| #16 | 🇪🇸 Spain | $1,389.9 |

| #17 | 🇮🇩 Indonesia | $1,289.4 |

| #18 | 🇸🇦 Saudi Arabia | $1,010.6 |

| #19 | 🇳🇱 Netherlands | $990.6 |

| #20 | 🇹🇷 Turkey | $853.5 |

| #21 | 🇹🇼 Taiwan | $828.7 |

| #22 | 🇨🇭 Switzerland | $807.4 |

| #23 | 🇵🇱 Poland | $716.3 |

| #24 | 🇦🇷 Argentina | $630.7 |

| #25 | 🇸🇪 Sweden | $603.9 |

| #26 | 🇧🇪 Belgium | $589.5 |

| #27 | 🇹🇭 Thailand | $534.8 |

| #28 | 🇮🇱 Israel | $527.2 |

| #29 | 🇮🇪 Ireland | $519.8 |

| #30 | 🇳🇴 Norway | $504.7 |

| #31 | 🇳🇬 Nigeria | $504.2 |

| #32 | 🇦🇪 United Arab Emirates | $503.9 |

| #33 | 🇪🇬 Egypt | $469.1 |

| #34 | 🇦🇹 Austria | $468.0 |

| #35 | 🇧🇩 Bangladesh | $460.8 |

| #36 | 🇲🇾 Malaysia | $434.1 |

| #37 | 🇸🇬 Singapore | $423.6 |

| #38 | 🇻🇳 Vietnam | $413.8 |

| #39 | 🇿🇦 South Africa | $411.5 |

| #40 | 🇵🇭 Philippines | $401.7 |

| #41 | 🇩🇰 Denmark | $386.7 |

| #42 | 🇵🇰 Pakistan | $376.5 |

| #43 | 🇭🇰 Hong Kong SAR | $368.4 |

| #44 | 🇨🇴 Colombia | $342.9 |

| #45 | 🇨🇱 Chile | $310.9 |

| #46 | 🇷🇴 Romania | $299.9 |

| #47 | 🇨🇿 Czech Republic | $295.6 |

| #48 | 🇮🇶 Iraq | $282.9 |

| #49 | 🇫🇮 Finland | $281.4 |

| #50 | 🇵🇹 Portugal | $255.9 |

| #51 | 🇳🇿 New Zealand | $242.7 |

| #52 | 🇵🇪 Peru | $239.3 |

| #53 | 🇰🇿 Kazakhstan | $224.3 |

| #54 | 🇬🇷 Greece | $222.0 |

| #55 | 🇶🇦 Qatar | $221.4 |

| #56 | 🇩🇿 Algeria | $187.2 |

| #57 | 🇭🇺 Hungary | $184.7 |

| #58 | 🇰🇼 Kuwait | $183.6 |

| #59 | 🇲🇦 Morocco | $142.9 |

| #60 | 🇦🇴 Angola | $124.8 |

| #61 | 🇵🇷 Puerto Rico | $118.7 |

| #62 | 🇪🇨 Ecuador | $115.5 |

| #63 | 🇰🇪 Kenya | $114.9 |

| #64 | 🇸🇰 Slovakia | $112.4 |

| #65 | 🇩🇴 Dominican Republic | $112.4 |

| #66 | 🇪🇹 Ethiopia | $111.2 |

| #67 | 🇴🇲 Oman | $109.0 |

| #68 | 🇬🇹 Guatemala | $91.3 |

| #69 | 🇧🇬 Bulgaria | $85.0 |

| #70 | 🇱🇺 Luxembourg | $82.2 |

| #71 | 🇻🇪 Venezuela | $82.1 |

| #72 | 🇧🇾 Belarus | $79.7 |

| #73 | 🇺🇿 Uzbekistan | $79.1 |

| #74 | 🇹🇿 Tanzania | $76.6 |

| #75 | 🇬🇭 Ghana | $76.0 |

| #76 | 🇹🇲 Turkmenistan | $74.4 |

| #77 | 🇱🇰 Sri Lanka | $73.7 |

| #78 | 🇺🇾 Uruguay | $71.2 |

| #79 | 🇵🇦 Panama | $71.1 |

| #80 | 🇦🇿 Azerbaijan | $70.1 |

| #81 | 🇭🇷 Croatia | $69.4 |

| #82 | 🇨🇮 Côte d'Ivoire | $68.6 |

| #83 | 🇨🇷 Costa Rica | $68.5 |

| #84 | 🇱🇹 Lithuania | $68.0 |

| #85 | 🇨🇩 Democratic Republic of the Congo | $63.9 |

| #86 | 🇷🇸 Serbia | $62.7 |

| #87 | 🇸🇮 Slovenia | $62.2 |

| #88 | 🇲🇲 Myanmar | $59.5 |

| #89 | 🇺🇬 Uganda | $48.4 |

| #90 | 🇯🇴 Jordan | $48.1 |

| #91 | 🇹🇳 Tunisia | $46.3 |

| #92 | 🇨🇲 Cameroon | $44.2 |

| #93 | 🇧🇭 Bahrain | $43.5 |

| #94 | 🇧🇴 Bolivia | $43.4 |

| #95 | 🇸🇩 Sudan | $42.8 |

| #96 | 🇵🇾 Paraguay | $41.9 |

| #97 | 🇱🇾 Libya | $40.8 |

| #98 | 🇱🇻 Latvia | $40.6 |

| #99 | 🇪🇪 Estonia | $39.1 |

| #100 | 🇳🇵 Nepal | $39.0 |

| #101 | 🇿🇼 Zimbabwe | $38.3 |

| #102 | 🇸🇻 El Salvador | $32.0 |

| #103 | 🇵🇬 Papua New Guinea | $31.4 |

| #104 | 🇭🇳 Honduras | $30.6 |

| #105 | 🇹🇹 Trinidad and Tobago | $29.3 |

| #106 | 🇰🇭 Cambodia | $28.3 |

| #107 | 🇮🇸 Iceland | $27.7 |

| #108 | 🇾🇪 Yemen | $27.6 |

| #109 | 🇸🇳 Senegal | $27.5 |

| #110 | 🇿🇲 Zambia | $27.0 |

| #111 | 🇨🇾 Cyprus | $26.7 |

| #112 | 🇬🇪 Georgia | $25.2 |

| #113 | 🇧🇦 Bosnia and Herzegovina | $23.7 |

| #114 | 🇲🇴 Macao SAR | $23.4 |

| #115 | 🇬🇦 Gabon | $22.2 |

| #116 | 🇭🇹 Haiti | $20.2 |

| #117 | 🇬🇳 Guinea | $19.7 |

| #118 | West Bank and Gaza | $18.8 |

| #119 | 🇧🇳 Brunei | $18.5 |

| #120 | 🇲🇱 Mali | $18.4 |

| #121 | 🇧🇫 Burkina Faso | $18.3 |

| #122 | 🇦🇱 Albania | $18.3 |

| #123 | 🇧🇼 Botswana | $18.0 |

| #124 | 🇲🇿 Mozambique | $17.9 |

| #125 | 🇦🇲 Armenia | $17.7 |

| #126 | 🇧🇯 Benin | $17.5 |

| #127 | 🇲🇹 Malta | $17.2 |

| #128 | 🇬🇶 Equatorial Guinea | $16.9 |

| #129 | 🇱🇦 Laos | $16.3 |

| #130 | 🇯🇲 Jamaica | $16.1 |

| #131 | 🇲🇳 Mongolia | $15.7 |

| #132 | 🇳🇮 Nicaragua | $15.7 |

| #133 | 🇲🇬 Madagascar | $15.1 |

| #134 | 🇬🇾 Guyana | $14.8 |

| #135 | 🇳🇪 Niger | $14.6 |

| #136 | 🇨🇬 Republic of Congo | $14.5 |

| #137 | 🇲🇰 North Macedonia | $14.1 |

| #138 | 🇲🇩 Moldova | $14.0 |

| #139 | 🇹🇩 Chad | $12.9 |

| #140 | 🇧🇸 The Bahamas | $12.7 |

| #141 | 🇳🇦 Namibia | $12.5 |

| #142 | 🇷🇼 Rwanda | $12.1 |

| #143 | 🇲🇼 Malawi | $11.6 |

| #144 | 🇲🇺 Mauritius | $11.5 |

| #145 | 🇲🇷 Mauritania | $10.1 |

| #146 | 🇹🇯 Tajikistan | $10.0 |

| #147 | 🇰🇬 Kyrgyzstan | $9.8 |

| #148 | 🇽🇰 Kosovo | $9.2 |

| #149 | 🇸🇴 Somalia | $8.4 |

| #150 | 🇹🇬 Togo | $8.4 |

| #151 | 🇲🇪 Montenegro | $6.1 |

| #152 | 🇲🇻 Maldives | $5.9 |

| #153 | 🇧🇧 Barbados | $5.8 |

| #154 | 🇫🇯 Fiji | $4.9 |

| #155 | 🇸🇸 South Sudan | $4.8 |

| #156 | 🇸🇿 Eswatini | $4.7 |

| #157 | 🇸🇱 Sierra Leone | $4.1 |

| #158 | 🇱🇷 Liberia | $3.9 |

| #159 | 🇩🇯 Djibouti | $3.7 |

| #160 | 🇧🇮 Burundi | $3.7 |

| #161 | 🇦🇼 Aruba | $3.5 |

| #162 | 🇦🇩 Andorra | $3.3 |

| #163 | 🇸🇷 Suriname | $3.0 |

| #164 | 🇧🇹 Bhutan | $2.7 |

| #165 | 🇧🇿 Belize | $2.7 |

| #166 | 🇱🇸 Lesotho | $2.5 |

| #167 | 🇨🇫 Central African Republic | $2.5 |

| #168 | 🇹🇱 Timor-Leste | $2.4 |

| #169 | 🇪🇷 Eritrea | $2.4 |

| #170 | 🇬🇲 The Gambia | $2.1 |

| #171 | 🇨🇻 Cabo Verde | $2.1 |

| #172 | 🇸🇨 Seychelles | $2.0 |

| #173 | 🇱🇨 St. Lucia | $2.0 |

| #174 | 🇦🇬 Antigua and Barbuda | $1.7 |

| #175 | 🇬🇼 Guinea-Bissau | $1.6 |

| #176 | 🇸🇲 San Marino | $1.6 |

| #177 | 🇸🇧 Solomon Islands | $1.6 |

| #178 | 🇰🇲 Comoros | $1.2 |

| #179 | 🇬🇩 Grenada | $1.2 |

| #180 | 🇰🇳 St. Kitts and Nevis | $1.1 |

| #181 | 🇻🇺 Vanuatu | $1.0 |

| #182 | 🇻🇨 St. Vincent and the Grenadines | $1.0 |

| #183 | 🇼🇸 Samoa | $0.83 |

| #184 | 🇩🇲 Dominica | $0.60 |

| #185 | 🇸🇹 São Tomé and Príncipe | $0.51 |

| #186 | 🇹🇴 Tonga | $0.50 |

| #187 | 🇫🇲 Micronesia | $0.43 |

| #188 | 🇲🇭 Marshall Islands | $0.27 |

| #189 | 🇵🇼 Palau | $0.23 |

| #190 | 🇰🇮 Kiribati | $0.21 |

| #191 | 🇳🇷 Nauru | $0.13 |

| #192 | 🇹🇻 Tuvalu | $0.06 |

| #193 | 🇺🇦 Ukraine | Data not available |

| Total World GDP | $101,559.3 |

Just five countries make up more than half of the world’s entire GDP in 2022: the U.S., China, Japan, India, and Germany. Interestingly, India replaced the UK this year as a top five economy.

Adding on another five countries (the top 10) makes up 66% of the global economy, and the top 25 countries comprise 84% of global GDP.

The World’s Smallest Economies

The rest of the world — the remaining 167 nations — make up 16% of global GDP. Many of the smallest economies are islands located in Oceania.

Here’s a look at the 20 smallest economies in the world:

| Country | GDP (Billions, USD) |

|---|---|

| 🇹🇻 Tuvalu | $0.06 |

| 🇳🇷 Nauru | $0.13 |

| 🇰🇮 Kiribati | $0.21 |

| 🇵🇼 Palau | $0.23 |

| 🇲🇭 Marshall Islands | $0.27 |

| 🇫🇲 Micronesia | $0.43 |

| 🇹🇴 Tonga | $0.50 |

| 🇸🇹 São Tomé and Príncipe | $0.51 |

| 🇩🇲 Dominica | $0.60 |

| 🇼🇸 Samoa | $0.83 |

| 🇻🇨 St. Vincent and the Grenadines | $0.95 |

| 🇻🇺 Vanuatu | $0.98 |

| 🇰🇳 St. Kitts and Nevis | $1.12 |

| 🇬🇩 Grenada | $1.19 |

| 🇰🇲 Comoros | $1.24 |

| 🇸🇧 Solomon Islands | $1.60 |

| 🇸🇲 San Marino | $1.62 |

| 🇬🇼 Guinea-Bissau | $1.62 |

| 🇦🇬 Antigua and Barbuda | $1.69 |

| 🇱🇨 St. Lucia | $1.97 |

Tuvalu has the smallest GDP of any country at just $64 million. Tuvalu is one of a dozen nations with a GDP of less than one billion dollars.

The Global Economy in 2023

Heading into 2023, there is much economic uncertainty. Many experts are anticipating a brief recession, although opinions differ on the definition of “brief”.

Some experts believe that China will buck the trend of economic downturn. If this prediction comes true, the country could own an even larger slice of the global GDP pie in the near future.

See what hundreds of experts are predicting for 2023 with our Global Forecast Series.

Where does this data come from?

Source: IMF (International Monetary Fund)

Data note: Due to conflict and other issues, some countries are not included in this data set (e.g. Ukraine, Syria, Afghanistan). Major sources for GDP data differ widely on the size of Iran’s economy. It’s worth noting that this data from IMF ranks Iran’s GDP much higher than World Bank or the UN.

Markets

Charted: The Rise of Major Currencies Against the U.S. Dollar in 2025

As the U.S. dollar weakened in 2025, we show the appreciation of several currencies against the U.S. dollar in a highly unpredictable year.

Published

5 days ago

on

January 14, 2026

Chart: The Rise of Major Currencies Against the U.S. Dollar in 2025

See visuals like this from many other data creators on our Voronoi app. Download it for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

- The Swedish krona gained 20.2% against the U.S. dollar in 2025, marking its biggest year of appreciation in decades.

- Many major currencies appreciated against the dollar last year given steep policy uncertainty and increasing central bank reserve diversification.

Donald Trump’s trade war was a major driver of U.S. dollar weakness in 2025, pushing trade policy uncertainty to historic levels.

At the same time, U.S. dollars held in foreign central bank reserves fell to 20-year lows. Given these dynamics, several major currencies, from the Swedish krona to the Brazilian real saw double-digit gains against the U.S. dollar amid lower global demand.

This graphic shows the appreciation of major currencies against the greenback in 2025, based on data from Bloomberg via The Bulwark.

The Performance of Major Currencies Against the U.S. Dollar

Below, we show how numerous currencies strengthened against the U.S. dollar in 2025:

| Currency | Appreciation in 2025 |

|---|---|

| 🇸🇪 Swedish Krona | 20.2% |

| 🇲🇽 Mexican Peso | 15.6% |

| 🇨🇭 Swiss Franc | 14.5% |

| 🇿🇦 South African Rand | 13.8% |

| 🇪🇺 Euro | 13.5% |

| 🇩🇰 Danish Krone | 13.3% |

| 🇳🇴 Norwegian Krone | 12.9% |

| 🇧🇷 Brazilian Real | 12.8% |

| 🇦🇺 Australian Dollar | 7.8% |

| 🇬🇧 British Pound | 7.7% |

| 🇸🇬 Singapore Dollar | 6.2% |

| 🇨🇦 Canadian Dollar | 4.8% |

| 🇹🇼 Taiwanese Dollar | 4.4% |

| 🇳🇿 New Zealand Dollar | 2.8% |

| 🇰🇷 South Korean Won | 2.2% |

| 🇯🇵 Japanese Yen | 0.3% |

With 20.2% gains, the Swedish krona saw its strongest performance against the dollar in decades.

The U.S. dollar weakened on softer economic data and policy expectations, and investors rebalanced into currencies like the krona amid relatively stronger Swedish growth prospects and economic fundamentals.

The Mexican peso had the second highest gains, strengthening 15.6% in 2025. This marked the best year since 1994, defying expectations given U.S. trade tensions. Among the factors underpinning the peso’s rise are resilient growth and macroeconomic stability.

Meanwhile, the South African rand rose 13.8% and the Brazilian real appreciated 12.8%.

Across Asian countries, the Singapore dollar increased 6.1%, serving as a “quasi safe haven” across the region. The global financial hub is known for its institutional strength and significant current account surplus, further supporting demand.

Learn More on the Voronoi App

To learn more about this topic, check out this graphic on the top 50 countries by central bank reserves.

Investor Education

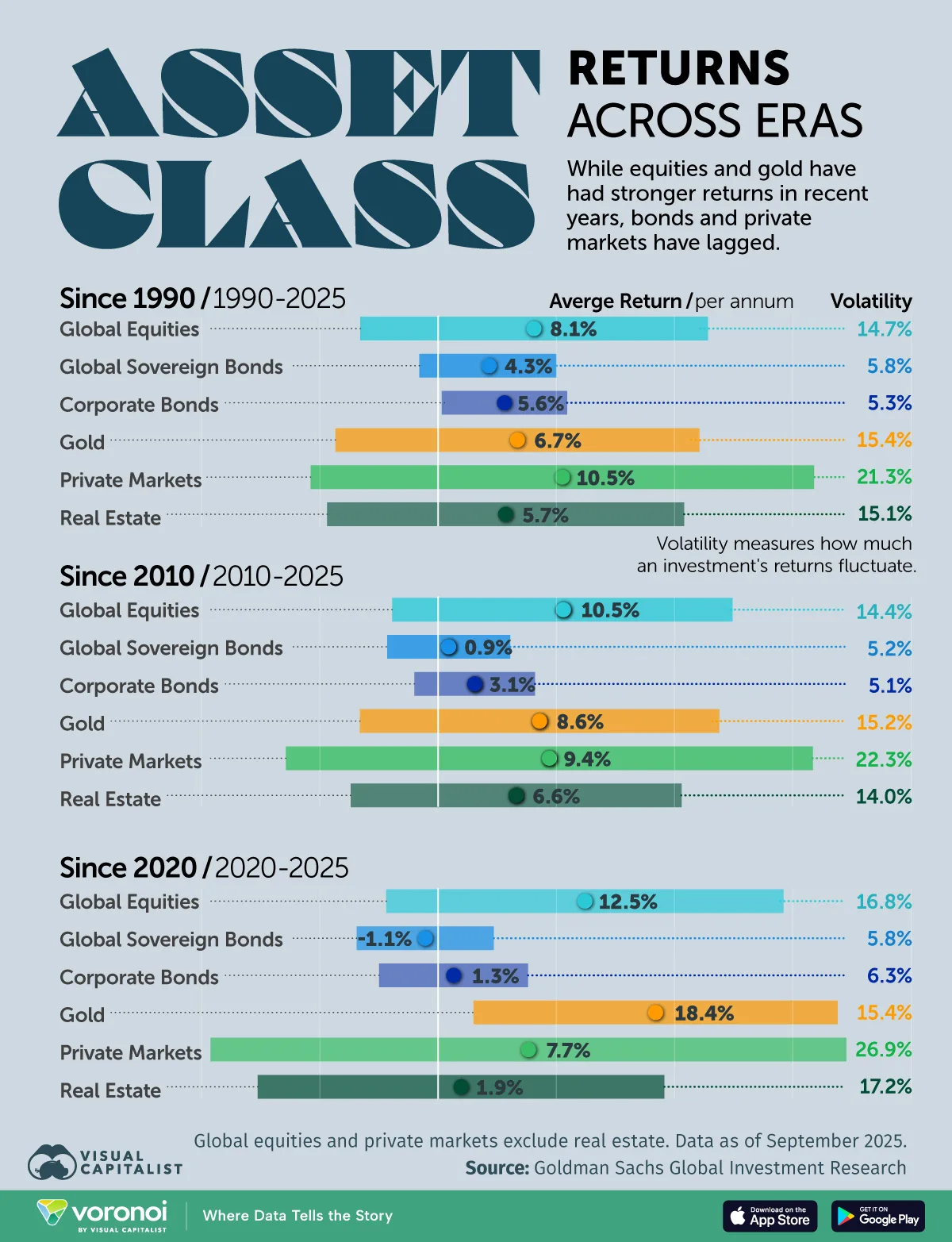

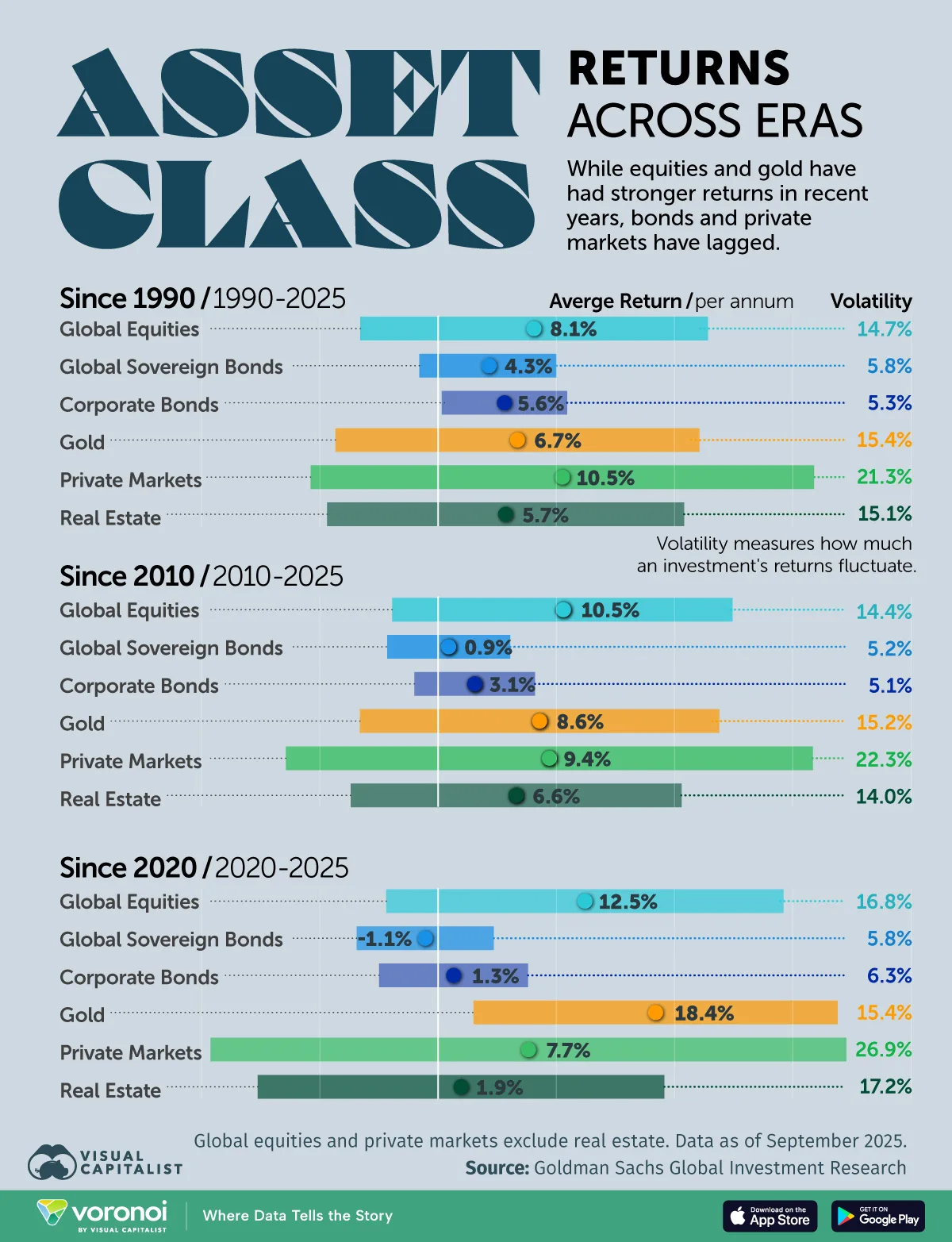

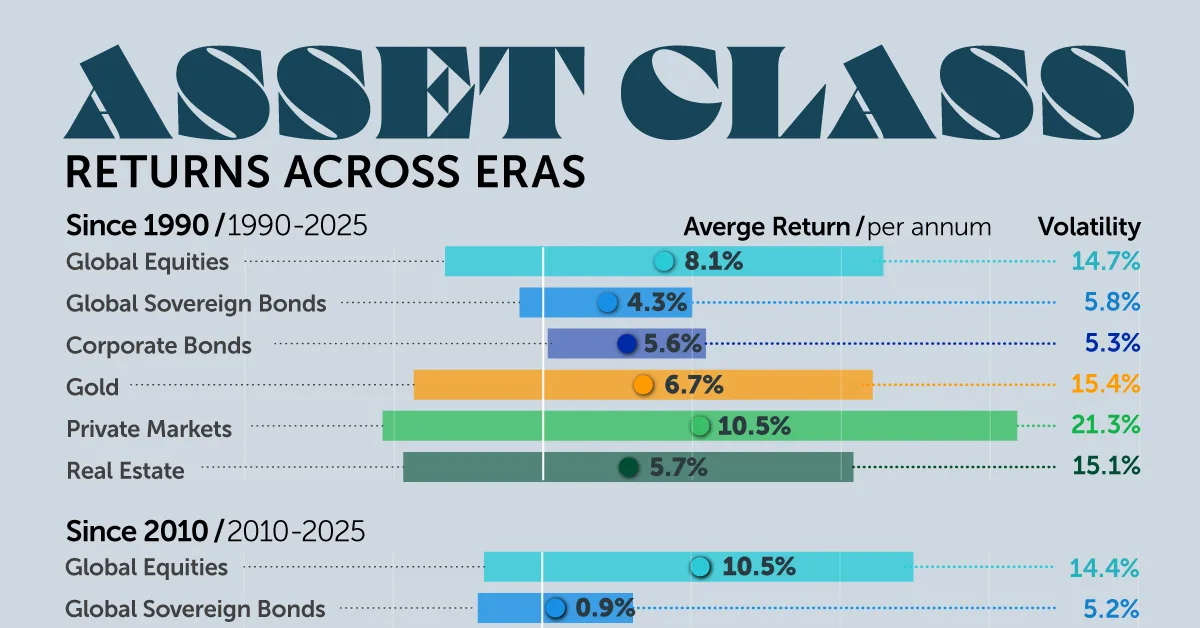

Charted: Asset Class Returns Across Eras (1990–2025)

Private markets show the highest long-term returns, while gold has been the best-performing asset since 2020.

Published

6 days ago

on

January 13, 2026

Charted: Asset Class Returns Across Eras (1990–2025)

See visuals like this from many other data creators on our Voronoi app. Download it for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

- Private markets delivered the strongest long-term returns since 1990, but with the highest volatility.

- Since 2020, gold has been the best-performing asset with an 18.4% annualized return.

- Bonds have struggled in recent years as higher interest rates and inflation weigh on fixed-income returns.

Investment performance can vary widely depending on the time period analyzed. While equities and gold have delivered strong returns in recent years, bonds and some alternative assets have lagged, especially in the post-pandemic era of rising interest rates.

This graphic breaks down annualized returns and volatility across major asset classes over three distinct periods: long-term (1990–2025), mid-term (2010–2025), and the most recent cycle (2020–2025), using data from Goldman Sachs. Global equities and private markets exclude real estate, and data is as of September 2025.

ℹ️ Understanding volatility: Volatility measures how much an investment’s returns fluctuate year to year. For example, a volatility of 10% implies that returns typically move about 10 percentage points above or below the average in a given year. While higher volatility often accompanies higher returns, it also increases the risk of short-term losses.

Long-Term Returns by Asset Class: 1990–2025

Over the past 35 years, risk assets have significantly outperformed safer alternatives.

| Asset Class | 1990–2025 Return (per annum) | Volatility |

|---|---|---|

| Global equities | 8.1% | 14.7% |

| Global sovereign bonds | 4.3% | 5.8% |

| Corporate bonds | 5.6% | 5.3% |

| Gold | 6.7% | 15.4% |

| Private markets | 10.5% | 21.3% |

| Real estate | 5.7% | 15.1% |

Private markets delivered the strongest annualized returns at 10.5%, although this came with substantial volatility of over 21%. Global equities also performed well, averaging just over 8% annually.

Bonds offered more modest but stable returns, while gold provided diversification benefits with mid-range returns and high volatility.

Post-Global Financial Crisis Asset Performance: 2010–2025

The period following the Global Financial Crisis was marked by low interest rates and strong equity performance.

| Asset Class | 2010–2025 Return (per annum) | Volatility |

|---|---|---|

| Global equities | 10.5% | 14.4% |

| Global sovereign bonds | 0.9% | 5.2% |

| Corporate bonds | 3.1% | 5.1% |

| Gold | 8.6% | 15.2% |

| Private markets | 9.4% | 22.3% |

| Real estate | 6.6% | 14.0% |

Global equities saw annualized returns rise to 10.5%, while private markets continued to outperform public assets.

In contrast, sovereign bonds struggled as yields compressed, delivering less than 1% annual returns. Gold remained resilient during this era, with prices rising sharply from 2009 to 2012, before falling and stabilizing.

Post-Pandemic Asset Class Returns: 2020–2025

The most recent five-year period highlights a sharp divergence across asset classes.

| Asset Class | 2020–2025 Return (per annum) | Volatility |

|---|---|---|

| Global equities | 12.5% | 16.8% |

| Global sovereign bonds | -1.1% | 5.8% |

| Corporate bonds | 1.3% | 6.3% |

| Gold | 18.4% | 15.4% |

| Private markets | 7.7% | 26.9% |

| Real estate | 1.9% | 17.2% |

Global equities delivered strong returns following the 2020 crash, despite market volatility.

Meanwhile, gold has been the best-performing asset amid rising inflation, geopolitical risks, and elevated interest rates, with prices hitting all-time highs twice since 2020.

Bonds experienced negative real and nominal performance as rapid interest rate hikes eroded prices. Rising inflation and high sovereign debt levels have put downward pressure on sovereign bond prices.

Furthermore, real estate has seen relatively low returns relative to medium- and long-term periods, with high mortgage rates dampening the demand for housing in many major markets.

Learn More on the Voronoi App

If you found this infographic interesting, explore more investing and market insights on Voronoi, including The Ups and Downs of Global Markets in 2025