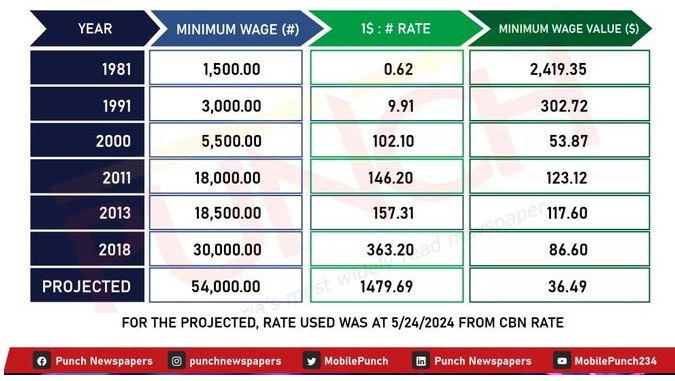

Continuing that conversation on why Nigeria’s monthly minimum wage was $2,419 in 1981 but now $37. I was still in Secondary Technical School Ovim when he was the president, and as a village kid, my problem was never food. You were guaranteed one loaf of Ezioma bread (15 kobo) in the morning. On the days after the main Oriendu Market, you could upgrade to Our Society bread. Our Society bread was “imported” from Enugu, from the bakery of Chief Umunna, who never forgot his village even though he was serving Enugu people.

Though what he was doing was not on my horizon, after reading books, I do conclude that Nigeria’s IBB (Babangida) was a good operator even though he scaled many bad things in the country. I mean he built Abuja, 3rd Mainland Bridge, and many other catalytic infrastructures. Yet, he messed up with SAP (structural adjustment programme), and in the bid to recover, he liberated the banking & financial sector at scale, without connecting them to manufacturing.

Today, from GTBank to Zenith Bank, Access to modern UBA, and beyond, some of the leading banks in Nigeria were created within 1989 to 1993, and a policy framework made that possible. Just like that, the financialization of Nigeria began, and that started the erosion of the core pillars of Nigeria. He made finance better but ignored manufacturing!

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

Financialization is a process whereby financial markets, financial institutions, and financial elites gain greater influence over economic policy and economic outcomes. Financialization transforms the functioning of economic systems at both the macro and micro levels.

The late 1970s and early 1980s

The illusion has been that the late 1970s and early 1980s were great because we had the oil boom. Not really, as we still have an oil boom today. In the 1980s, we pumped about 400,000 bpd at about $36 per barrel. Today, we do close to 1.2 million bpd at close to$80 . Even if you adjust for population, Nigeria has more resources today than the late 1970s! (Under constant US dollar, we made $14.4m daily vs $96m today which under constant currency is a 6.7 factor. Population in 1981 was 75 million for today’s 210 million which is a factor of 2.3. In other words, we have scaled oil revenue faster than population, meaning the boom of today is greater).

So, do not say the late 1970s and early 1980s were better because of oil. Something is missing and here is it: Nigeria has stopped making things in Nigeria. Today, we have financialized Nigeria’s economy, as banking and financial services rose, and manufacturing faded. In the 1980s, the known entrepreneurs in Kano, Aba, Abeokuta, etc made things. Today, we grow apps, and have mastered how to pay, receive and move money!

Simply, Nigeria’s problem is not that oil money has stopped; our problem is that post the 1980s SAP, our economy was reconfigured with finance houses, banking, etc and people found out that you could invest N1,000 and wait for a 20% return without doing anything. With that financial engineering everywhere, everyone joined the club and starved the manufacturing (old, modern, hybrid and services) sector. Of course, with easy money, productivity dropped, corruption demons grew, and a nation began the descent.

How do I know? Nigeria creates policies for financial services at more than 8:1 which means for one policy on manufacturing, we have 8 on financialization. Do you want the test? Tell me the last 8 things you know about the banking circulars and remind me of one you know for the manufacturers. You have no chance for the manufacturers but you can list those bank-focused policies.

Good People, even if we double our oil production, Nigeria will not advance until we start making things again!

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube