Analysis looks at differences in claims filed between men and women

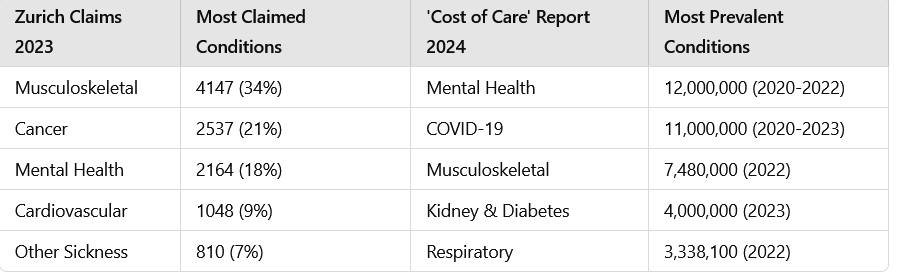

Zurich Financial Services Australia (Zurich) has published its analysis of life insurance claims for 2023, identifying musculoskeletal conditions, cancer, and mental health as the leading causes of claims.

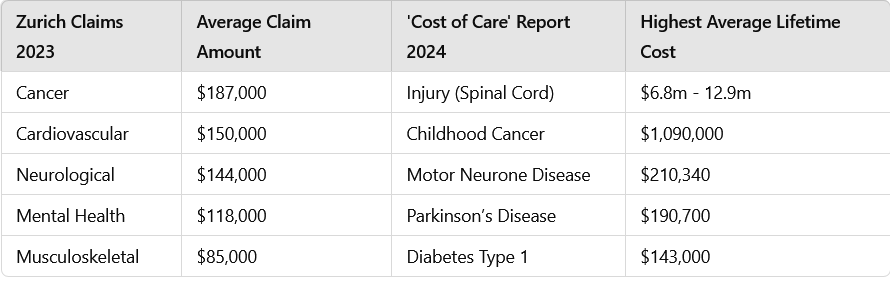

Highest average life insurance claims at Zurich in 2023

The highest average claim amount was for cancer at $187,000, followed by cardiovascular claims at $150,000, neurological claims at $144,000, and mental health claims at $118,000.

Some of these conditions saw significant increases in average claim amounts from the previous year.

Zurich life insurance claims received from male versus female customers in 2023

The analysis showed that men were more likely to claim for musculoskeletal conditions, while women were more likely to claim for mental health conditions and cancer.

Mental health issues were the most common conditions from 2020 to 2022, with more than 12 million cases. COVID-19 followed closely, with around 11 million reported cases in the same period. Focusing on cancer, the report noted significant increases in prostate cancer (+44%), breast cancer (+14%), and melanoma (+27%).

“Both Zurich’s claims data and ‘Cost of Care’ analysis highlight a growing need for Australians to prioritise resilience and prevention across their health and finances,” said Zurich chief claims officer Matt Paterson said. “This area will continue to be a strong focus for Zurich and the value we offer our customers, with data playing a key role in the continued evolution of these services.”