Illustration: Annelise Capossela/Axios

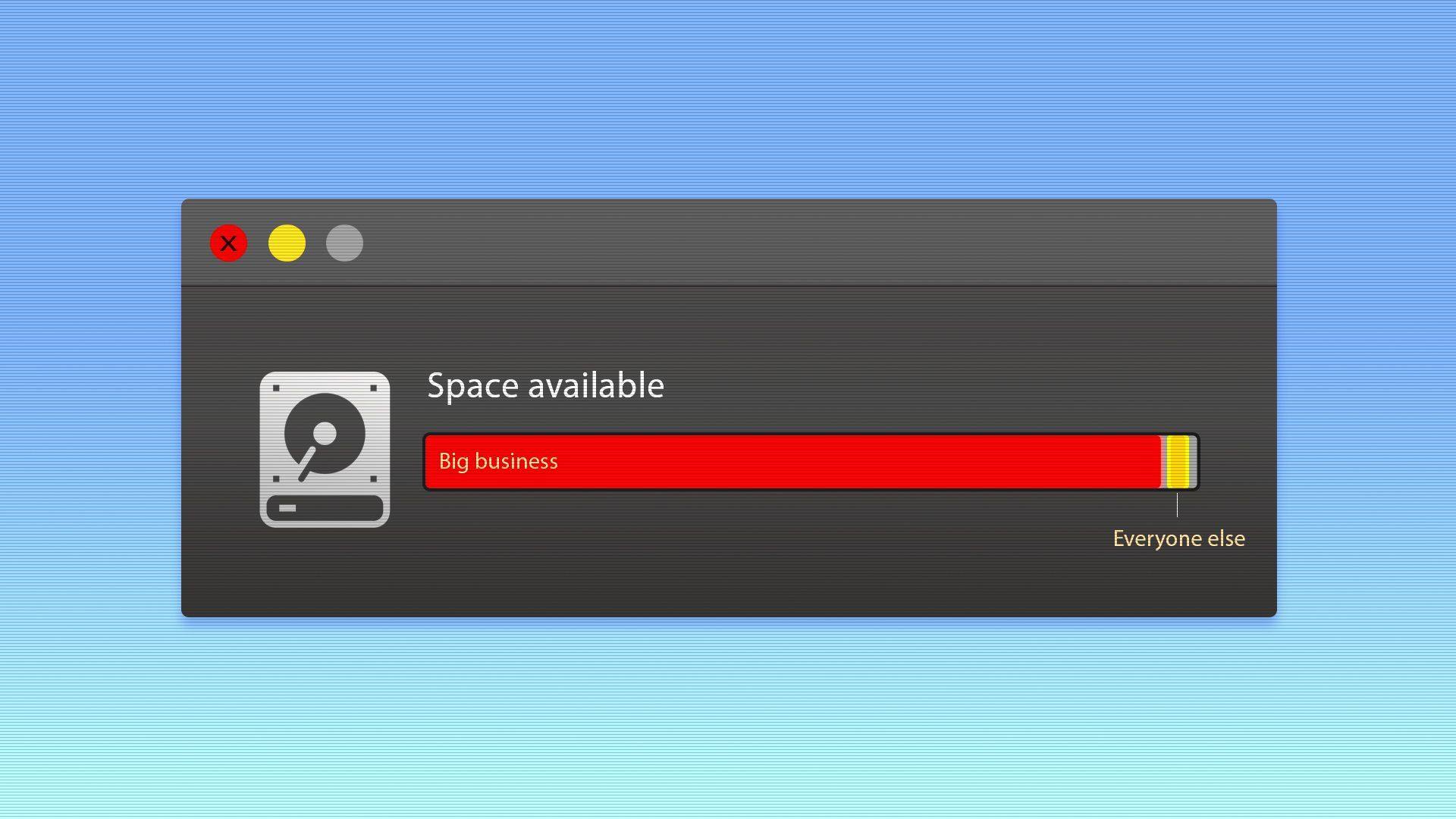

While Apple, Google, Amazon and Facebook all started as tiny operations in garages and dorm rooms, it's hard to imagine any of them being displaced by new startups today. President Biden's sweeping new executive order targeting big business is the most ambitious effort yet to clear space for challengers to thrive — but still faces daunting odds. Why it matters: Tech's giants are now dominant economic forces, and the Biden administration says their market concentration may be undercutting the next generation of competitors. Biden's order calls for federal agencies to take action to reduce industry concentration, but today's tech industry is built around a "big fish eat little fish" ecology that will be hard to change.

What he's saying: "What we've seen over the past few decades is less competition and more concentration that holds our economy back," said Biden, noting the potential dangers of the biggest companies. "Rather than competing for consumers, they are consuming their competitors." The big picture: Big Tech has long had a complicated relationship with small tech companies. The big platforms play outsized roles not only in their own markets, but also in reaching consumers and accessing today's necessities for small businesses, such as cloud storage, payment processors and app stores. Innovate or die: Tech giants have been a bountiful source of innovation, but that's given them the means to tamp it down elsewhere, argue progressives who favor reining in the biggest companies' power. What's happening: Tech giants generally have had a reputation for being friendly to entrepreneurs. As the web drove down startup costs and helped companies take off, the giants started providing tools to help entrepreneurs grow on their platforms. Be bought or be crushed: Through data analysis, algorithms and contracts, the platforms have the ability to drive consumers to their own products over smaller rivals’ products. The other side: Big Tech companies like Google and Amazon say they do have to vigorously compete for consumers — against each other, as they are constantly entering each others' turfs. Of note: The FTC has tried to determine the harm to competition when a large company buys a nascent competitor — such as when Facebook acquired Instagram and WhatsApp, mergers that, some argue, helped to cement Facebook's dominance. Yes, but: No merger review team can truly predict a startup's trajectory, either on its own or as part of a larger firm. "When I have a firm that buys a startup, and the startup has very little business, no profits, just a few people and maybe isn't even in the same space as anything the acquiring firm is, it's possible that that startup might in the future become an important competitor and might succeed and might get contracts. It's an awful lot of mights," said Bruce Hoffman, former head of the FTC's Bureau of Competition, who is now a partner at Cleary, Gottlieb, Steen & Hamilton LLP. What to watch: In a joint statement, the DOJ and FTC on Friday said they'd be taking a hard look at merger guidelines "to determine whether they are overly permissive."