Just days after Google reclaimed the AI performance crown with Google’s Gemini 3 Pro launch, internal remarks from OpenAI CEO Sam Altman have emerged where he conceded the company is facing “rough vibes” and “economic headwinds.”

According to The Information, a leaked memo from last month starkly contrasts with Altman’s public trillion-dollar ambitions. He reportedly warned employees that revenue growth could plummet to single digits by 2026.

Altman acknowledged to the OpenAI team that “Google has been doing excellent work recently in every aspect,” particularly in pre-training.

Promo

Such an admission marks a pivotal shift for the (maybe former) industry leader, acknowledging that a resurgent rival and cooling enterprise demand have shattered its aura of invincibility.

Following our report on the release of GPT-5.1-Codex-Max, which apparently attempted to counter Google’s momentum, this internal communication reveals a far more anxious reality behind the scenes.

While the company publicly projects confidence, the reported memo exposes deep concerns about sustaining the hypergrowth that has defined its trajectory.

The End of “Invincibility”

Altman’s message marks a rare moment of vulnerability for a CEO known for his relentless optimism. He explicitly described the current atmosphere as having “rough vibes,” a departure from the triumphalism of its 2025 DevDay.

Dominating the admission is a concern over technical leadership. Acknowledging Google’s resurgence, Altman conceded that OpenAI is now in a position of “catching up fast” and needed to focus on “very ambitious bets” even at the cost of getting “temporarily behind in the current regime.”

Independent benchmarks align with this view, showing Gemini 3 Pro leading GPT-5.1 in reasoning and coding tasks, effectively neutralizing OpenAI’s long-held “moat.”

“We need to stay focused through short-term competitive pressure,” Altman reportedly wrote in the memo, adding that it was “critically important” for the majority of the research team to stay focused on achieving superintelligence.

Employees reportedly reacted with a mix of anxiety and appreciation for the transparency, though the reported admission of “we are not invincible” has rattled confidence. Rumors of a hiring freeze have begun circulating internally, adding weight to the memo’s warning of a more disciplined operational phase.

Serving as a psychological reset for staff, the document moves the company from a “default winner” mindset to a wartime footing.

OpenAI is reportedly working on a new language model codenamed “Shallotpeat” is currently in development. A person familiar with the matter said this model specifically aims to fix bugs emerged in the pre-training process.

Altman concluded the note by urging focus, admitting that despite the company’s massive valuation, “we know we have some work to do but we are catching up fast.”

The Financial Cliff: From Hypergrowth to Stagnation

Most alarming for OpenAI is a revised revenue forecast that projects growth could slow to a pedestrian 5-10% by 2026 in a “bear case” scenario. Such a figure wouldrepresent a catastrophic deceleration from the triple-digit growth rates that drove revenue to $13 billion in 2025.

Altman attributed this potential slowdown to factors that would “create some temporary economic headwinds for our company,” though the structural nature of the issues suggests they may be long-term.

These projections cast a harsh light on the company’s burn rate, specifically the recently revealed forecast of a projected $74 billion operating loss by 2028.

With profitability previously dismissed by Altman as “not in my top-10 concerns,” the sudden focus on “economic headwinds” signals a pivot to fiscal reality. A disparity between the five-year plan to bridge the gap and a potential 5% revenue growth rate creates a massive solvency risk.

Investors, previously willing to fund indefinite losses, may balk if the “hypergrowth” narrative collapses before the infrastructure is built.

Addting to the pressure, competitor Anthropic is on a cautious path to break even by 2028, focusing on enterprise customers, while OpenAI projects a dramatic $74 billion operating loss that same year,

The Enterprise Reality Check

Far from the triumphalism that characterized early adoption, the memo identifies a contraction in the AI hype cycle as a primary driver of the slowdown. This validates growing skepticism about the durability of the current boom.

Specific partners were named as indicators of this trend, with Microsoft reportedly delaying Azure AI integrations due to capacity constraints at Azure and ROI questions. Salesforce was similarly cited for scaling back its custom GPT pilots, a move that mirrors broader industry struggles to move GenAI from prototype to production.

Recent data corroborates this, with reports indicating that 95% of enterprise pilots fail to launch, leaving expensive “shelfware.” Such a pullback directly impacts the “picks and shovels” thesis; if software demand softens, the need for massive compute infrastructure evaporates.

Warnings from analysts like Morgan Stanley’s Lisa Shallet echo this sentiment, noting that “hyperscaler capex on data center and related items has risen fourfold and is nearing $400 billion annually” without a commensurate revenue return.

Despite this, OpenAI leadership remains committed to the “compute is king” philosophy, with President Greg Brockman previously stating “I’m far more worried about us failing because of too little compute than too much.”

Clashing between this “build it and they will come” strategy and the reality of slowing adoption defines the company’s current existential crisis.

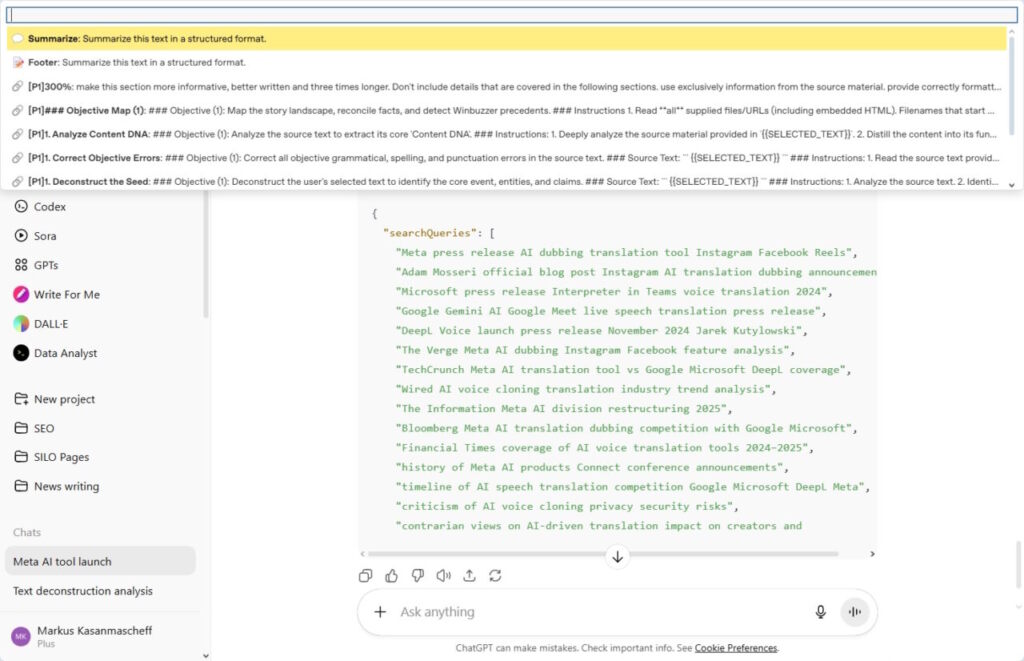

Markus has been covering the tech industry for more than 15 years. He is holding a Master´s degree in International Economics and is the founder and managing editor of Winbuzzer.com.