Reference and pricing data on government, corporate and US municipal bonds with the simplest API on the market. From sign up to data in minutes.

Government & Corporate

Bond Data

Essential data on 50,000+ government and corporate bonds, including reference data, EOD pricing and yields. Includes developed world and emerging market countries. Corporate bonds include US and European issues.

US Municipal

Bond Data

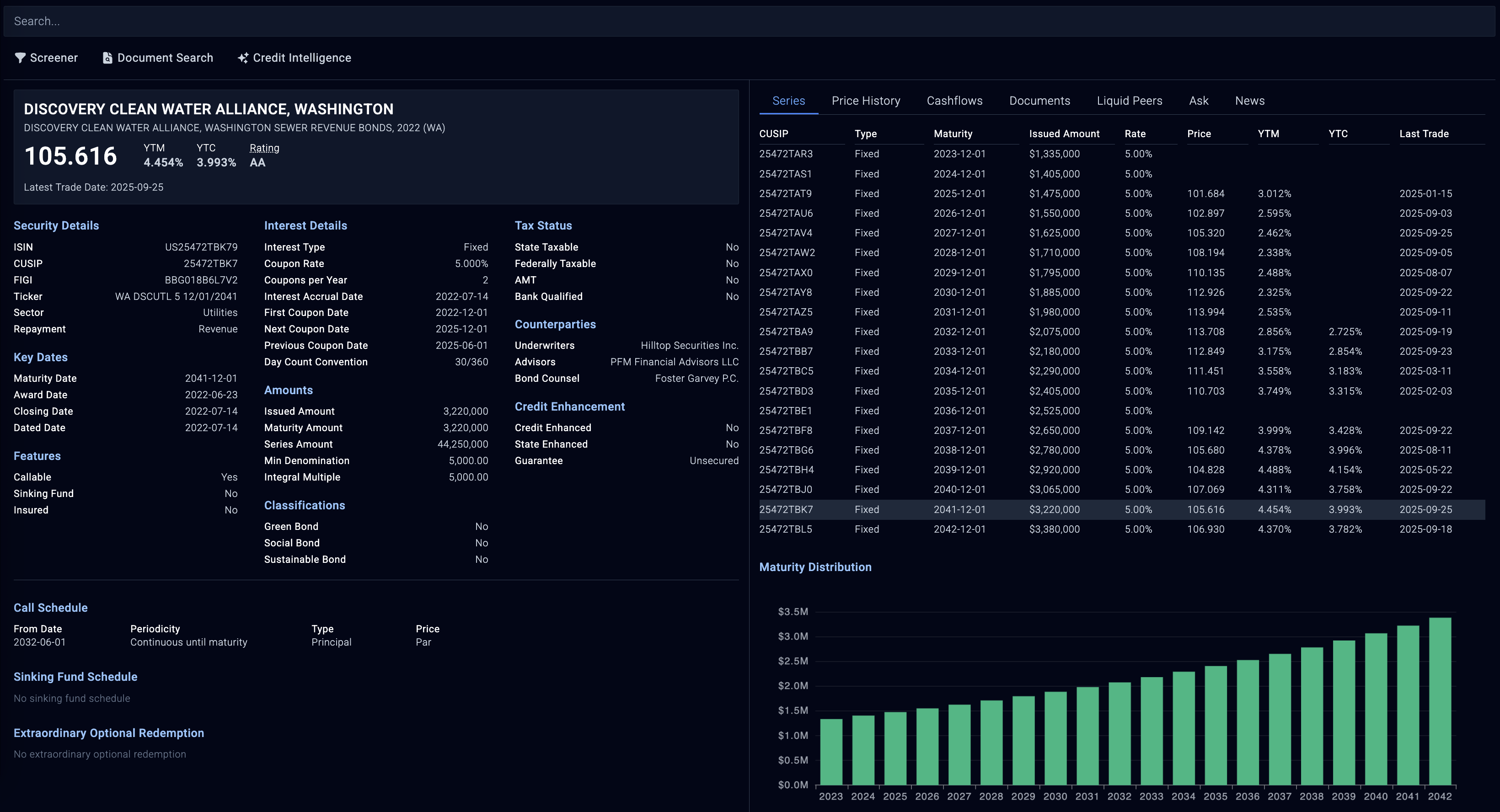

In-depth reference and pricing data on 1.2 million municipal bonds across 50,000+ issuers. Access 100+ data-points including call, make-whole, and sinking fund schedules, cashflows, tax status, pricing, and more.

Municipal Credit

Intel Platform

Our AI-powered data platform helps municipal credit analysts quickly and accurately identify risks, metrics, financials, and trends across thousands of disclosures.

Why choose Terrapin for your fixed income data needs

We simplify the way institutional investors navigate, explore, and analyze their bond universe. We empower service providers to create the next generation of products.

Flexible licensing

Our licenses are designed to empower our clients rather than restrict them. Share and collaborate with your team, or integrate into client reports without breaking unexpected clauses. Build, analyze, and share without compliance bottlenecks.

Fair pricing

We aim to grow with our clients, so our pricing is designed to adapt to each client's scale and needs. With more features and deeper intelligence, we provide exceptional value without the excessive price tag.

User experience

A modern API with clear docs. Get your data in JSON or CSV via our API, on a per security basis or in bulk. Spend your time researching, not integrating. Get complimentary dedicated onboarding support to ensure speedy and correct integration with your systems.

Client support

Speak directly with the founders and engineers through a dedicated Slack channel. Unlike other providers, our entire team is dedicated to hands-on support, ensuring your data flows smoothly and errors are patched in a timely manner.

Vertical integration

Having built a vertically integrated fixed income data platform, from source collection to extraction to delivery, we are able to offer a unique and comprehensive solution to our clients, without the need for external partners.

Aligned incentives

Unlike most data conglomerates, we are a pure data and research provider with no conflicts of interest, so we can focus on providing the best possible service without imposing artificial barriers.

Fixed income data solutions for market professionals

Fintechs and platforms

Our data API is used by fintechs and platforms to power their research, client interfaces and analytics. We offer flexible distribution rights so that you can focus on building instead of compliance.

Asset managers and hedge funds

Go further with historical pricing and reference data. Generate complex cashflow and analytics to power backtesting, risk management and analytics. Build indices and custom curves to power your portfolio construction.

Municipal credit analysts

Our AI-powered credit intelligence tool, backed by our extensive reference data and official document library, helps you quickly and accurately identify and analyze municipal credit risks, opportunities and trends.

Depth and breadth

Basic and complex data fields to get the full picture of each bond

We provide the foundational data for institutional investors to streamline their analysis. Build custom curves, design indices, measure risk, and access cashflow information all within our API-first platform.

Developer experience

Unmatched accessibility

At Terrapin, everything is built with the end user in mind. Our API is designed to be simple, fast, and easy to use. We provide modern documentation, output in JSON or CSV, and Jupyter notebooks for data exploration.

Onboard and pull the data into your systems in days instead of months.

A fixed income data provider that doesn't hold you back

We believe that data should not be a barrier to innovation. Having built a vertically integrated fixed income data platform, from source collection to extraction to delivery, we are able to offer a unique and comprehensive solution to our clients without the need for external partners, onerous licensing agreements or constraining pricing.

Frequently Asked Questions

Get answers to common questions about our fixed income data platform

We have full coverage of US Municipal Bonds (1.2M+ securities across 50,000+ issuers), government bonds (US Treasuries, Gilts, Bunds, etc.), with limited coverage of US and European corporate bonds.

Each US municipal bond has over 60 data-points including full call, sinking fund and interest payment schedules to accurately model securities at any level - individual, issuer, state, sector, and more.

Our data is captured directly from primary sources such as official statements and disclosures. We extract data from these sources using our own proprietary AI models in a process that is 99% automated, with the support of a small team of analysts.

Our models and datasets are built by our team of PhDs, engineers and financial professionals.

We are fully vertically integrated, from source collection to extraction to delivery, so we control every step of the process.

Our data is bulk-collected and extracted overnight, with additional intra-day fixes and updates. All data updates are available immediately via our API.

Yes, all clients receive access to a dedicated Slack channel for direct support from our team. You can speak directly with founders and engineers when needed. We also provide complimentary onboarding and integration support.

Our licenses are designed to empower rather than restrict. You can share data with your team and integrate it into client reports without worrying about breaking unexpected clauses. We believe in transparent, fair licensing that grows with your business.

Yes, we provide extensive historical reference data and executed pricing information. Our municipal bond database includes historical issuance data, and our pricing feeds include historical EOD prices and yields where available.

Still have questions?