Please Note: Blog posts are not selected, edited or screened by Seeking Alpha editors.

Continuing the theme in these blog posts highlighting the inaccuracies of financial analysts reporting on coronavirus, a report was released by Moody;s yesterday,it is a follow up to a report on the 18th of February. The media release of February 18th states: "Our baseline assumption is that the economic effects of the coronavirus outbreak will continue for a number of weeks before tailing off and allowing normal economic activity to resume, says Christian de Guzman, a Moody's Senior Vice President." This was long after many epidemiologists I know had sold out of stocks. Reviewing my emails by February 9th I was putting the eventual risk of a pandemic at 90-95%

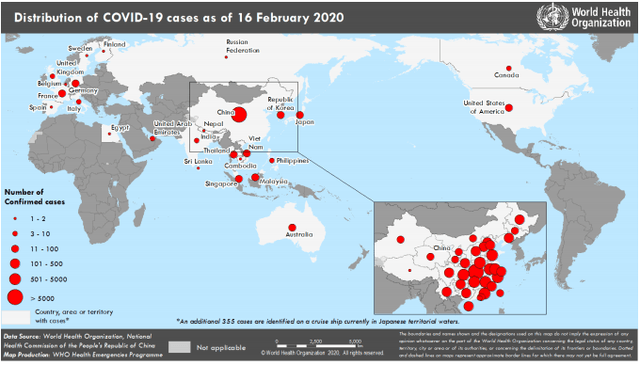

Let me remind you what the WHO Situation report showed on February 16th (2 days before release of the first Moodys report). We can see there were 25 countries with cases. With many countries reporting concerning local transmission including Germany, Singapore, Korea, and Japan.

Now to the second report released by Moody's on the 27th of February claiming a 40% chance of COVID-19 becoming a pandemic.

40%

This second report comes 5 days after it was clear there was an uncontrolled outbreak in Italy with so many cases that had obviously started weeks previously. By the 26th February there were almost 400 cases in Italy and cases were disseminating into adjacent European countries, Korea was out of control, there were cases popping up in Israel.

Even Iran had happened and still 40%. Iran had obviously completely missed a large outbreak with no chance of controlling it in the near term with cases already occurring in adjacent countries. The outbreak centred around the crowded pilgrimage city of Qom which attracts pilgrims from around the world. The 12 deaths reported by February 25th suggested around 12,000 cases had occurred over prior weeks to contribute to this many deaths.

The second report comes 5 days after modellers at Imperial College London released an analysis finding that approximately two thirds of COVID-19 cases exported from China had gone undetected. There was still a dearth of cases identified in Africa and Indonesia which should have rung alarm bells. It was obvious cases were being missed in many countries and even if China managed to control the virus there would be many other countries that could reseed a pandemic.

It may be that Moody's didn't see the Imperial College report or grasp the significance of Iran's and Italy's late recognition of their outbreaks. It may be that they don't know who the credible modellers in infectious disease epidemiology are. But then you have to ask - why are they writing these reports if it so far outside their area of expertise?

A pandemic is simply the global spread of a new, and usually severe, infectious disease. While WHO has not yet called a pandemic and seems reluctant to do so, perhaps due to being accused of "calling wolf" over the relatively mild 2009 influenza pandemic, many experienced infectious disease epidemiologists accept we are there. Many were at 50% probability of a pandemic in late January to early February, that puts Moodys about 4 weeks behind the curve.

Dr Craig Dalton is a public health physician and conjoint Associate Professor at the University of Newcastle, Australia. He is a former CDC Epidemic Intelligence Service Officer and runs Flutracking.net one of the largest national surveillance systems for influenza-like illness in the world.

Analyst’s Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.