Snap is the most asymmetric bet in big tech. A billion users, world-class research, AR/VR, so much damn data, on-device GenAI yet pales in market share to Meta, Tiktok, Google. Something doesn't add up.

After 8 years as the market's punching bag, the CEO dropped a memo that reads like he finally woke up. I analysed all of it: the 344 research papers, the engineering, the team reorganisation, the culture shift, the new monetisation strategies, the CEO's memo and crunched the numbers to figure out if this is a legit turnaround or if Snap stays broken forever

Full disclosure: I'm obviously invested. More than I probably should be. But this is not a pump piece. Nor is it finance bro SeekingAlpha/Morningstar slop. I don't care if you invest. This is a research and engineering driven report.

More important full disclosure: THIS IS NOT FINANCIAL ADVICE.

The Memo

The CEO Evan Spiegel released a charismatic note in 2025, company-wide then online, detailing his 14 years at the company. It reads like an awakening, realising how far behind Snapchat is to the rest of their competitors.

With all due respect to Evan, the market has not characterised him as the best tech CEO and that is evident in the markets valuation of Snap. Over the years investors both retail and institutional have gotten weary and tired of him dumping his shares on them, diluting to pay out big equity to retain/hire talent and spend heavily on R&D at the cost of turning a profit.

His somber acknowledgement:

"Achieving net income profitability would also help offset the dilution risk of stock-based compensation and establish a stronger foundation under our share price."

However this memo may be what gets him in their good graces. PROVIDED he can execute.

The Market

We're in an AI boom pronounced bubble. Whether you pay attention to the markets or not you'll have heard all sorts of insane valuations, acquisitions, salaries, big fat numbers being floated around all around.

Snap Inc has seen none of this. While AI-adjacent tech is up ~33% YTD ($AIQ ETF as a measure) $SNAP is down ~30%.

Yet product-wise, research-wise, talent-wise they seem best-positioned to reap the rewards of this? Especially when compared to the other huge players in the space: Meta ($1.6T) and Apple ($3.8T). Snapchat is at a measly $14B.

Taken from the CEO's mouth:

“Our current stock price reflects doubt. At this valuation, there's startup-style return potential.”

I agree.

A Product Transforming

Shipping for the sake of shipping is terrible. Overloading young, teen brains with a quadrillion features that are unlikely to stick. Remember the average teen attention span is like what 7 seconds? If they don't adopt a feature (likely only adopted because a friend did) they never will.

At one point snapchat had 5 whole tabs as they struggled to keep up with Instagram and Tiktok taking their lunch and innovating and handling product/GTM like crazy.

These 5 tabs have now been collapsed to 3:

- Messages + Stories: Social graph content

- Camera

- For You feed: the Tiktok-style algorithmic feed that now combines both stories and spotlight

This is the first time Snapchat unified disparate content types (friend Stories + creator Spotlight videos) into a single recommendation system. Previously these were separate feeds with separate algorithms. Now it's one ML-powered infinite scroll.

By Q4 2024, this rolled out to 25+ million users. Early metrics show increased content engagement from casual users - people who previously just messaged friends are now watching video content.

No point fighting that Tiktok won the format war, time to adapt but leverage your golden ticket: the social graph. Now on Snapchat, Your For You feed is not just what's trending globally but what your friends are sharing, what's trending in your circle.

From their engineering team:

"Two-Tower Models for Spotlight achieved double-digit engagement gains. We deployed Mixture of Experts architecture and Graph Neural Networks (LLaGA - Large Language and Graph Assistant) to process petabytes of data for 850+ million users."

The result: Spotlight content views increased 300% YoY in 2024.

Capitalising

Snapchat has nearly 1 BILLION monthly active users and 477 MILLION daily active users. Insane numbers. Not much to show for it. They are under 1% of the global digital ad market. Google - 39%, Meta - 23%. They've not done well here.

"We remain under 1% share of a global digital ad market that is growing 13% year-over-year, which means the opportunity is enormous."

But they're finally demonstrating some form of business acumen and it required breaking their own rules.

Q4 2024, Snap did something they swore they'd never do, they put ads in your inbox. Sponsored Snaps are full video ads delivered directly to your chat tab. Disney was the launch partner. The messages appear with a "Sponsored" tag, no push notifications, auto-delete if you don't open them. Except the real play isn't the ads themselves. Imagine ordering food through a Chick Fil A Sponsored Snap, having an AI handle customisation, payment, delivery tracking without ever leaving the chat. Sounds like the WeChat model, we'll see a lot more similarities to our Chinese friends throughout this post.

Also in Q4 2024, they released Promoted Places on Snap Map. Sponsored location markers that highlight restaurants, stores, events, McDonald's got the first spot. Early data shows 17.6% visitation lift for frequent Snapchat users who see a location marked as "Top Pick." 300M+ users check Snap Map regularly and Promoted Places turns that into ad inventory.

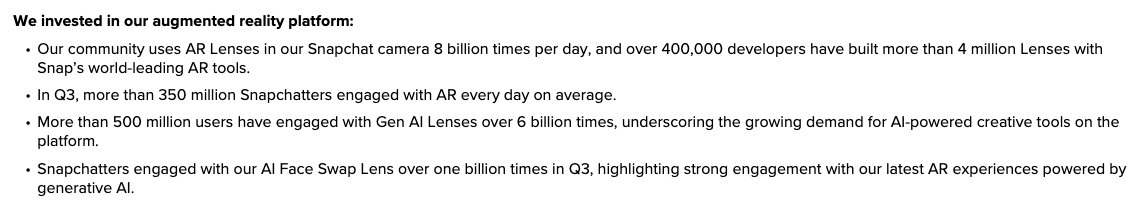

Then there's Catalog Shopping Lenses which hit 5B+ interactions; brands like Louis Vuitton and Chanel paying Snap to license AR try-on tech via their SDK. That's B2B revenue separate from ads.

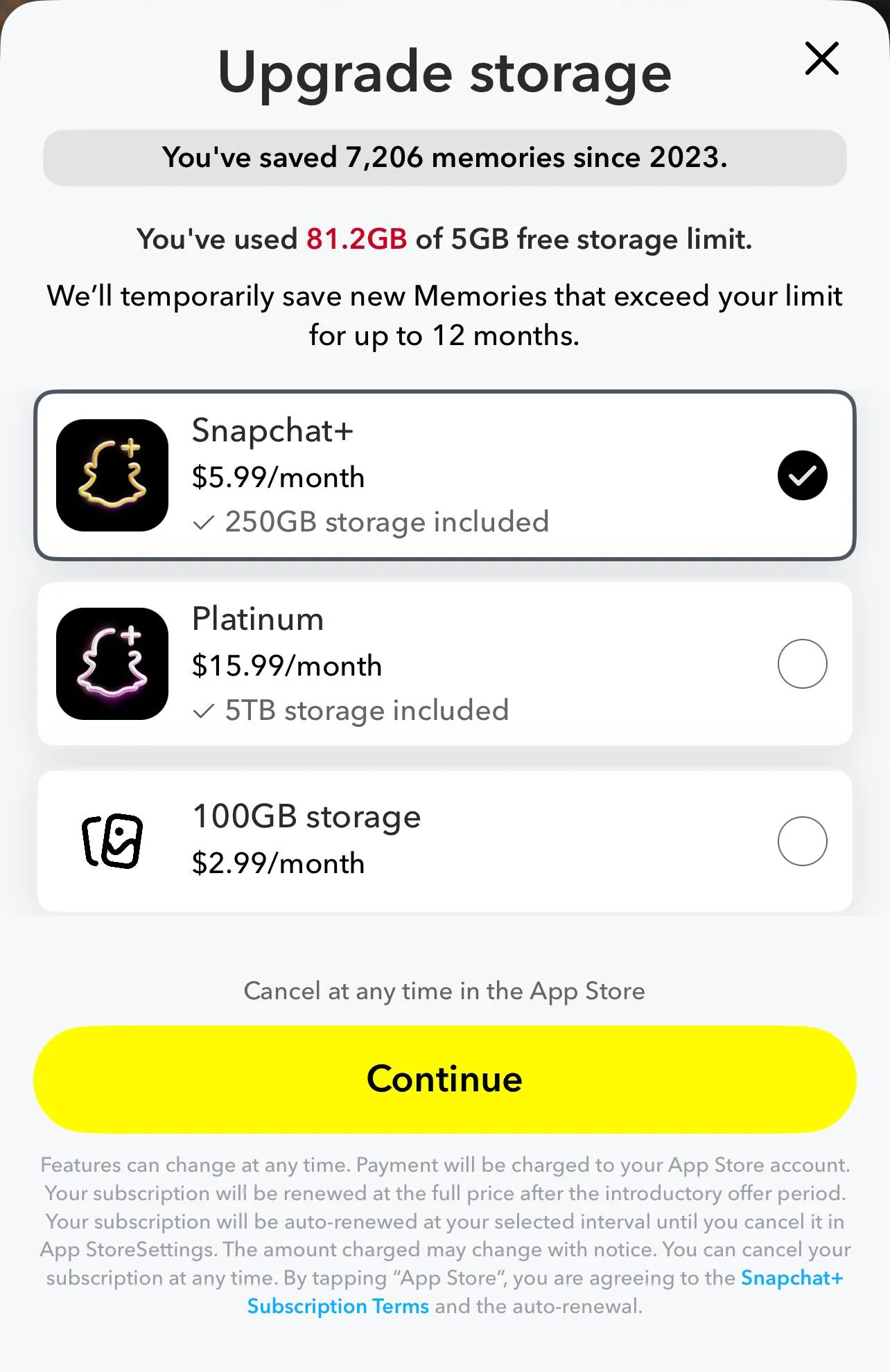

And they're finally CHARGING users for MEMORIES storage.

If you're unfamiliar with Snapchat, users can store pictures and videos directly on the platform in their "Memories" bank, this feature allows for seamless integration with other engagement features like sharing, reposting, editing this media on the platform. Great idea? Well it was completely FREE to store GIGABYTES of data per user on the SNAPCHAT CLOUD for 12+ YEARS. Until now.

See while most companies panicked to jam, glue and hack AI into their existing products. For Snap it was seamless, because they'd been doing it for so many years already.

"Snapchat is one of the only places where AI can be woven directly into the fabric of your friendships, Snaps, and conversations. We don't just want to make AI smarter. We want to make it more personal, social, and fun. Our vision for AI enhances your relationships, instead of replacing them."

Big players are catching on. Perplexity is paying Snap $400 MILLION over one year (cash + equity) to embed their AI search directly into Snapchat. Not licensing Snap's tech. Perplexity is paying for distribution to 1B users.

But the fact that a major revenue stream of theirs 'Snapchat+'' ("with more than 15 million subscribers and more than $700 million in ARR") was not a primary objective and only released late-2022 is telling.

Who was sleeping at the wheel and why? Well it seems to be finally changing.

Don't worry if these words mean nothing to you, most mean nothing to me too.

Don't worry if these words mean nothing to you, most mean nothing to me too.

Research and Development

Snap spent $1.744B on R&D in year ending September 2025. That's 25-30% of revenue. Meta spends ~27% (but on a way bigger budget).

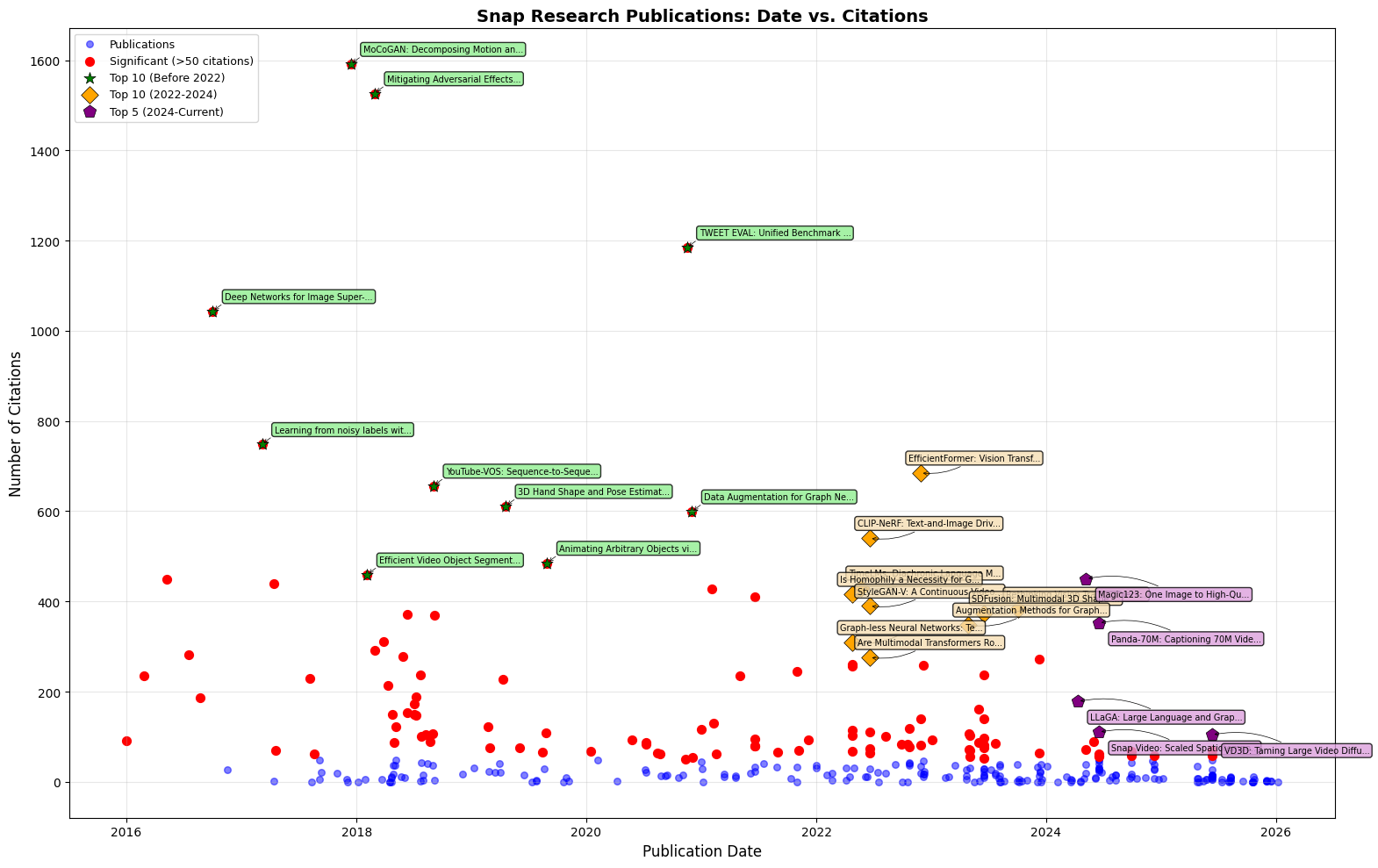

I analysed all 344 papers from Snap Research with their citation counts.

344 papers analyzed. Evolution from foundational CV (pre-2022, 1000+ citations) → applied ML systems (2022-2024, 400-700 citations) → on-device GenAI (2024+, rapidly accumulating citations).

344 papers analyzed. Evolution from foundational CV (pre-2022, 1000+ citations) → applied ML systems (2022-2024, 400-700 citations) → on-device GenAI (2024+, rapidly accumulating citations).

Let's see where all these R&D dollars went and how they translate to product.

Computer Vision & GenAI Research

The citation data shows depth across the entire computer vision stack:

- 3D Reconstruction: 3D Hand Shape and Pose from RGB (2019) - 611 citations. Single-image 3D estimation that powers AR hand tracking.

- Video Object Segmentation: YouTube-VOS (2018) - 656 citations. Benchmark dataset that defined the field.

- Neural Rendering: CLIP-NeRF (2022) - 540 citations. Text-and-image driven manipulation of neural radiance fields.

- Motion Transfer: Animating Arbitrary Objects via Deep Motion Transfer (2019) - 485 citations. Technology behind Snapchat's object animation filters.

At CVPR 2023, they presented 12 papers with a 70% acceptance rate (typical CVPR acceptance is 25-30%).

In 2024, they shipped real-time GenAI on mobile devices. Type a prompt, get AR effects in real-time on your phone. This is quite crazy as everyone else is busy making cloud-inference faster and cheaper (bigger models obviously but you get the point).

Everyone else is optimizing cloud inference: bigger GPUs, better networking, model compression for faster serving. Snap went the opposite direction: shrink the models enough to run entirely on your phone. SnapGen does text-to-image in under a second on mobile. SnapGen-V generates 5-second videos in 5 seconds on-device. They're trying to beat GPT-5's response time with a model 1/100th the size that runs locally. For AR filters, good enough and instant beats perfect and slow.

Graph Neural Networks & Social Research

Obviously a social media company should be doing graph research. It directly powers friend recommendations, content ranking and other social dynamics.

Graph Neural Networks:

- Data Augmentation for GNNs (2020) - 599 citations. Fundamental work on making GNNs actually work with limited labels.

- Is Homophily a Necessity for GNNs (2022) - 416 citations, challenging core assumptions about how social graphs behave.

- Graph-less Neural Networks (2022) - 309 citations, distilling graph knowledge into faster MLPs for production (Woah now we're going graphless?).

LLaGA (2024) - 178 citations, Large Language and Graph Assistant that combines LLMs with graph structure. The future of social recommendations, understanding both what you say and who you're connected to. It powers "People You May Know" and Spotlight recommendations and also very useful for safety and moderation.

Spectacles (AR/VR)

A lot of companies appear to be scaling back on AR/VR R&D spending but does this mean it was a bad bet or just that they went too far?

Meta slashed their metaverse budget

but

Apple's hiring for the Vision Pro

is still growing significantly despite the product not being an overwhelming success.

Snap may have the ugliest pair of glasses on the market, but they also have the best tech (FOV, immersion, AI capabilities), the best integrations, the greatest engagement and the largest bank of AR/VR data thanks to Snapchat. They're making the smartest platform play.

Spectacles 5 shipped to developers only at $99/month. Weighs only 226g with 45min runtime complete with hand tracking and others. It runs Snap OS their new AR operating system with 0% developer tax. Meanwhile Apple takes 30% and Meta takes 30% on Quest.

However, Apple and Meta can afford to tax because they have ecosystems. Zero percent is either the moat (switching costs once devs build for Snap OS) or a sign they know nobody would build for them otherwise. Their launch partners included LEGO, Niantic, ILM (Star Wars).

They have a big data advantage 300M+ daily AR users on Snapchat, 5B+ AR shopping interactions, 77% of DAUs have used AR. No other company has this much AR usage data for training models.

Serious numbers.

Serious numbers.

And now in the CEOs memo he mentions potential use cases aside from entertainment - WORK, REAL PRODUCTIVE MONEY MAKING WORK:

"AI is transforming the way we work, shifting us from micromanaging files and apps to supervising agents. And the costs of manufacturing physical goods are skyrocketing. Specs address all three challenges with eyes-up computing, a new AI-native operating system that understands your context, and the replacement of physical products with photons, reducing waste while opening a vast new economy of digital goods."

Lowkey that reads like slop... Let's see what else he said:

"Imagine pulling up last week's document just by asking or reviewing a 3D prototype at scale with your teammate standing next to you."

Hmm, better. Maybe a rebrand on its way? Snapwork? Why not? Maybe target some enterprise SaaS/PaaS/hardware marketshare. They have the tech, the talent, the data, and despite the dilution concerns, the capital to make this happen.

Moonshots and Internal Restructuring

"We're going to try a new way of organizing around a handful of our big, new bets. Five to seven squads of 10 to 15 people—will run like startups inside Snap, with single-threaded leaders accountable for outcomes. Weekly demo days, 90-day mission cycles, and a culture of fast failure will keep us moving."

This sort of restructure may seem daunting to a lot of you. Firstly, it's only for moonshot projects or big bets, similar to Spotify's Squads/Tribes model, Google X or early Palantirean culture. Intimate teams, high accountability and most importantly focused solely on results not promotions or self-interests like some of the bigger companies, no names... It's okay to fail, just keep moving.

"Our platform teams will be enablers, handing squads the toolkits and guardrails to ship safely at speed."

THIS IS ESPECIALLY GOOD. I can even go as far as to say without this it would've been certain to fail.

The core platform team remains unchanged - too much change breaks things and it is super irresponsible to break the core platform.

Core platform teams provide unified tools and guardrails - everyone is on the same damn page. This is a huge problem at other companies where teams operate in the same manner but with ZERO cross-team communication. No centralised source of truth. It results in the company having teams working on the building identical tools and workflows, serious productivity drain. It even happens at companies like the aforementioned Palantir and Google (even Deepmind). Identifying this problem ahead of time is excellent.

Core Engineering

Now for some strict engineering talk.

As someone who is primarily an engineer and secondarily an investor, I look toward serious engineering efforts when gauging company and culture shifts.

Infrastructure Optimisation

"our goal is to hold spending flat from 2025 to 2026 by improving compute and machine learning utilisation, and tailoring our cost to serve different features based on their long-term monetisation potential"

Big. They're optimising compute efficiency and tiering infrastructure based on business value. That's what mature engineering orgs do. You don't serve every feature with the same compute budget when some make $0 and others print money.

Real-Time ML Systems

"We recently shipped streaming logjoin, reducing end-to-end latency by two hours and driving measurable gains in favorites. We rolled out dynamic embeddings, removing the technical limits that capped our model size and unblocking scale. These breakthroughs mean our content systems can now update continuously, moving toward two-hour training cycles instead of days-long delays."

Two-hour reduction in latency means their recommendation systems are reacting to user behavior in near real-time instead of batch processing overnight. Dynamic embeddings solving model size limits suggests they hit scaling bottlenecks and actually fixed them instead of throwing hardware at it. Honestly... No idea what streaming logjoin is.

Two-hour training cycles vs days-long delays is the difference between relevant content and stale feeds. TikTok's algorithm advantage is partly this exact thing, real-time model updates.

First-Party Payments Infrastructure

"see an opportunity to reduce platform fees by building our own first-party wallet, which could eventually result in significant savings"

Building payment infrastructure in-house is non-trivial. Snap+ is at $700M ARR. If Apple/Google take 30%, that's $210M/year gone.

A first-party wallet means they can bypass platform fees entirely for in-app purchases, creator payouts, and digital goods. More importantly, it creates a closed-loop economy where money stays on the platform. Users load balances, spend within the ecosystem, Snap takes a cut (and potentially earns on float like PayPal).

The WeChat model. Once you have a payment rail, you can build an entire economy on top without giving Apple/Google a third of every transaction.

Shout out to Epic Games in their battle against the big Apple.

The Bear Case

I've been bullish for 2000 words. Let's balance it out a bit by talking about the risks.

North America is Flat (Uhhh what about the Appalachian mountains? 🤓)

DAU in North America: 98M (Q3 2025) vs 100M (Q2 2024). Their core market is stagnant or declining. Europe is flat at 100M. All the growth is coming from Rest of World, where ARPU is $1.11. Yeah... A dollar per user per quarter.

Global ARPU is $3.16. Compare that to Meta's $14.48+ ARPU.

The Spectacles Graveyard

They've burned cash on AR glasses for years with basically zero ROI. Specs 5 launches in 2026. Will this generation finally monetise?

The AR vision is compelling (get it?), but Apple has a lot more to spend and an insane product/commercial team and still couldn't make Vision Pro a hit. Meta is spending $10B+/year on Reality Labs, not much commerical success there (apart from those weirdos that film women). What makes Snap different?

TikTok Owns Short-Form Video

Spotlight growth is real (300% YoY increase in content), but TikTok has 1.5B+ users and owns the format. Snap is playing catchup in their own backyard and Instagram Reels has Meta's distribution and ad infrastructure.

Snapchat's differentiation was ephemeral content and the social graph. Spotlight must compete head-to-head with TikTok's algorithm.

The Numbers

55% gross margin is okay for a tech company, not great. Adjusted Operating Expense Margin is 57%. They're spending more on operations than they're making in gross profit.

Free cash flow was $93M in Q3. They generated $414M over the trailing twelve months. Is that enough cushion for the ambitious roadmap in the memo?

Q3 2025 earnings show a net loss of $104M. They're improving (down from $153M YoY).

Stock-based compensation was $260M in Q3 alone. That's dilution you're eating as a shareholder. However, SBC as a percentage of revenue has dropped from 35% in 2022 to ~20% in 2024. Still high, but trending down. They also announced a $500M buyback, which is a first.

The Profitability Question

Adjusted EBITDA was $182M in Q3 (12% margin). Better than last year's $132M, but still not net income positive. When does this company actually make money? The memo talks about "holding spending flat" but doesn't commit to profitability targets.

Investors have been waiting years for Snap to turn the corner. The market priced in this skepticism, hence the $14B valuation. But if execution slips, the downside is real.

I'm Still Bullish

"Who still uses Snapchat 🤓?" - You're 38 years old bud. Consider that you may not be the primary target market.

Look I'm not pretending this is safe. I'm betting that this time is different, that Evan finally locks in.

If you completely disagree or if you simply have any questions or comments or want to chat, shout me -> ossamachaib.cs@gmail.com.