With our small business we’ve used premium subscription services to several of the current top AI platforms to see what kind of impact we could have. With less than $10 million in revenue and ~25 employees, this was an opportunity to see what was possible with limited resources.

As artificial intelligence gains traction in every corner of industry, manufacturers are understandably eager to capture its promised efficiencies. But in the real world of small and midsized manufacturing businesses, AI’s impact is far from uniform. We set out to apply AI tools across both sales and operations—and quickly learned that not all use cases deliver equal value. In operations, where processes are bounded and data is more structured, AI proved transformational by leading to shorter production times and faster shipment of products. In contrast, its impact in sales was limited, providing insights but no financial gains. What follows is our firsthand account of what worked, what didn’t, and where other manufacturers can expect the biggest – and fastest – returns.

Context & Current Systems

Our only IT systems are MS Office (Outlook, .xlsx) and QuickBooks. We’ve got a wonky CRM that is largely used by account managers to track their own activity – it has little ability to generate reports or allow for sales director oversight. There is no ERP, MRP or CRM. The business produces sewn filters for industrial sites and pharmaceutical manufacturers. We purchase raw materials – filter media (fabrics, felts, wovens, meshes, nonwovens, membranes, etc.) slit them, cut them, and then form them into final products. Our site is largely produce-to-order, we carry minimal inventory. Sourcing can be quite sophisticated to bring in products for life science customers that meet their compliance requirements.

Over the past two years we’ve sold ~1,000 SKUs to ~300 accounts.

Sales

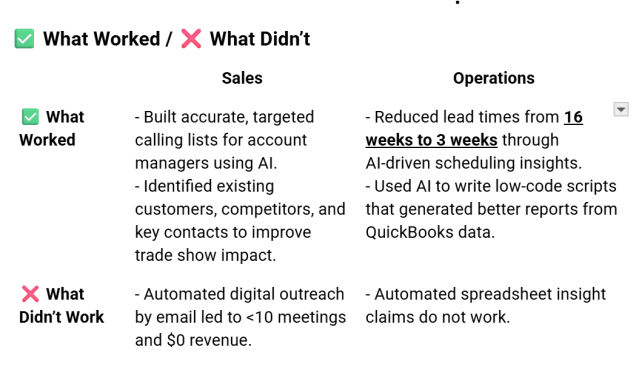

What worked: We were able to use current AI capabilities to create calling lists for account managers. Some of our end markets are very specific and regulated, so the accounts are well known. In one market there are 4,000 relevant plants in the US. Using AI we were able to build thorough lists of contacts in the market. We were able to use those lists to dramatically improve account manager effectiveness at major trade shows – identifying who was already buying from us, who our major competitors were at target accounts, and this created more effective selling strategies.

What did not work: Automated digital outreach had little to no impact. Prior to our engagement the company was spending ~$60k per year on Google Ads spending with no results. We took that spend down to $0 and instead brought in a contract email outreach firm at a cost of $1,800 per month ($21.6 k per year / ~1/3 the cost of the previous approach). While we were successful in using AI to map the market and understand the opportunity set, this engagement led to <10 meetings and $0 in revenue.

Operations

In both sales and operations, we were new to the business and our primary goal in using AI was first to get a better understanding of what was really going on with the business. While we had a goal in sales of “grow revenue” that was secondary to the initial goal of “understand current sales and customers.” In operations we had a similar primary goal – with no ERP/MRP or systems and with a QuickBooks implementation focused on monthly results, our cadence was simply too slow for the market we are in. The initial goal was “understand our current operations metrics” followed by a ‘Goal 1.1’ of “convert our important metrics from monthly outlook to a rolling weekly output.”

Within operations we needed first to understand what we were doing on our shop floor, we then needed to communicate operational metrics into something that was actionable for the entire team in order to improve throughput.

Initial Blindspots in Operations

- Not tracking time to produce each SKU. The plant is high-flex and almost all products in the end markets are customized. Further, we had two dramatically different markets – life sciences and heavy industry. Because of previous cost accounting decisions, time to produce each item was ignored. This was identified in our second week at the site – thereafter we set about each day identifying most complex / most simple products on each side of the business and working with the production team to calculate production times. On the industrial side this ranged from 30 seconds to 90s. On the life science side this ranged from 90s to 4.5 days per part! From a fixed variable approach, it was right to ignore the costs, as the skilled labor could not be easily replaced – however, time is a constraint. The team could easily focus on 4.5 days-to-complete parts which would then constrain revenue and free cash flow.

- Ship times not tracked, ship times too long. In previous years when the order backlog grew, the company simply added it to the end of the production cycle rather than figuring out how to pull in production to meet customer expectations. Customers prefer the products be shipped immediately, however they recognize that with customization this is not feasible. The site’s lead times had stretched out as far as 16 weeks! We worked with the operator crews to let them know that this was unacceptable and would limit their own earning potential. It was crucial to convert orders into products as fast as possible, acknowledging that we were build to order with limited ability to stock inventory due to the customization required. This would become a key area to use AI.

- Sandbagging revenue / artificial financial smoothing / monthly focus. The company’s lenders looked at reports on a monthly basis. In the hand off from previous management, there had been an emphasis on ‘smooth and predictable’ revenue – however, our experience in the industry and manufacturing led us to question that necessity. We brought this issue up with the banks, who acknowledged that their goal, like ours, was improved performance on a quarterly and annual basis. Smoothing did not benefit their goals. We prepared them for the impact of a move to throughput accounting and proceeded to implement a weekly focus on the production floor to match the cadence expected from buyers.

AI in Operations

What worked: We focused first on lead times, and with the better data made possible from AI, we were able to get leadtimes from 16 weeks down to three weeks. The company has been at three weeks now for the past 90 days. We used AI to take standard QuickBook order entry reports that were used to generate our production schedule and individual travelers that rode with production orders, and create more insights as to possible constraints. We could prioritize constraints based on revenue, cash generation, raw material availability, and complexity as soon as we began to use the tool. AI gave us an extra level of insight compared to what we were then getting out of QuickBooks. We used the AI to write python scripts that compared existing reports and created new automated reports with improved pivot-tables and functionality. We spent two weeks playing with the existing reports and then a week writing the scripts. Once the new code was written we were able to immediately run comparisons quickly multiple times per day dramatically improving the sophistication of our production planning using data we already had by adding an information layer.

What did not work: When we talked with other small and medium businesses (“SMBs”) we had a perception we would be able to simply upload our existing reports and ask for insights. That did not work at all. ChatGPT’s spreadsheet functionality has never worked as is currently claimed. Other systems were not much better. However, we were comfortable enough coding that the ‘low-code’ capability made possible by the AI tools we evaluated were very successful.

Conclusions

We attempted to use AI in a manufacturing business in both the sales and operations functions. For both, the initial phase was analysis. The results were much better in operations where the questions were more bounded and our access to data more structured. We showed that improved reporting in a poor MRP/ERP environment greatly improved using low-code software and cut ship times significantly – from 16 weeks down to three. Sales results helped in analyzing the customer universe, but ultimately made no financial impact. From conversations with other SMBs, we believe that this will hold true in other businesses – manufacturers will see the greatest and fastest payback from the use of AI in operational improvements. This improvement, when used to focus on results that benefit customers through lower costs and superior quality, can then lead to improved sales.