“We underestimated the scale and complexity of the issues, we ignored the signals about the need for additional time to refine the game on the base last-gen consoles,” Kiciński said in a conference call.

“We were updating the game on last-gen consoles until the very last minute, and we thought we’d make it in time,” joint-CEO Marcin Iwiński said in the same call. “Unfortunately, this resulted in giving it to reviewers just one day before the release, which was definitely too late, and the media didn’t get the chance to review it properly. That was not intended; we were just fixing the game until the very last moment.”

CD Projekt Red said in a filing over the weekend it would defend itself “vigorously” against the shareholders’ claims.

Meeting expectations

Given the ongoing debacle of the Cyberpunk 2077 launch, an investor suit seemed all but inevitable. This kind of legal action is incredibly common anytime a company takes a major PR hit.

Under US law, publicly traded companies have a fiduciary duty to their shareholders. Basically, officers of a corporation have a legal obligation to act in the company’s, and its investors’, best interest. Shareholders and corporate officers have a tendency to interpret this as a legal duty to maximize the company’s profits, although that is not exactly what the law says.

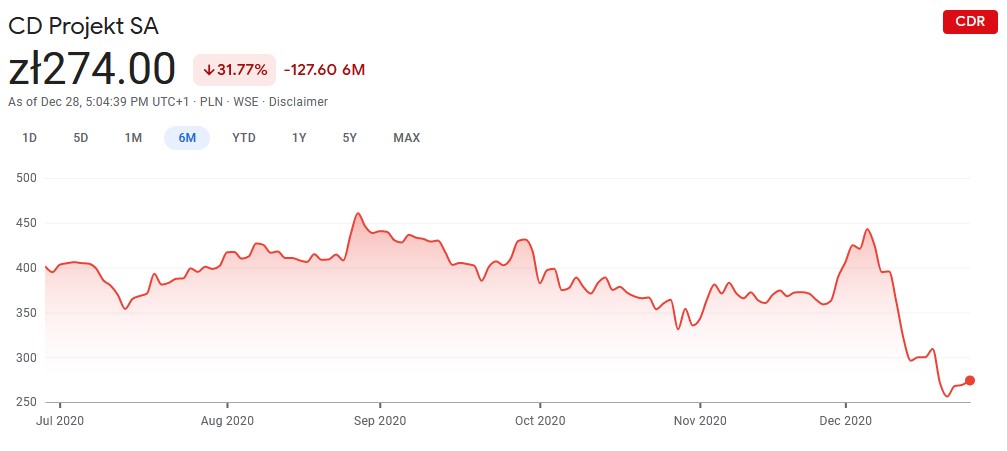

The December peak in CDPR’s stock price came on Dec. 4. Outlets (including Ars) began publishing reviews on Dec. 7 (the first drop), the game was released on Dec. 10 (the middle of the big downward slope), and Sony delisted the game on Dec. 17 (the tiny little peaklet right before the second drop).

Credit: Google Finance

The December peak in CDPR’s stock price came on Dec. 4. Outlets (including Ars) began publishing reviews on Dec. 7 (the first drop), the game was released on Dec. 10 (the middle of the big downward slope), and Sony delisted the game on Dec. 17 (the tiny little peaklet right before the second drop).

Credit:

Google Finance

The argument in this kind of shareholder suit basically says: The company did something it should not have—lied about something, downplayed a risk, made a colossal error in judgement, and so on—and as a result, harmed the company’s public image and, in turn, harmed investors.

Pinterest shareholders, for example, filed a suit against that company earlier this month claiming the board failed its fiduciary duty as allegations of rampant race- and gender-based discrimination inside the company were hurting its image with its largely-female user base. Google settled a similar shareholder suit in September, over its handling of harassment claims inside the company. And back in April, Zoom investors sued the overnight videoconference sensation, arguing that the company should have known its product was not up to spec before the pandemic hit.