![Timeline: The March to a Billion Users [Chart]](https://www.visualcapitalist.com/wp-content/uploads/2016/02/the-race-to-1-billion-users-chart.png)

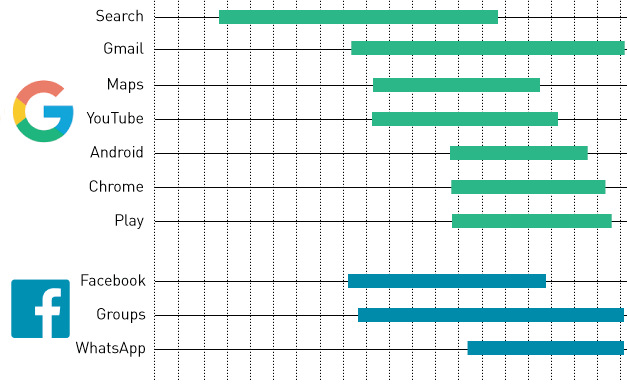

The March to a Billion Users

How long did it take for each app to hit the 1B mark?

The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

With approximately 3.3 billion people now using the internet, how hard can it possibly be to reach one billion of them each month?

It turns out that it’s quite a challenge.

Apple, the largest company by market capitalization, doesn’t have a single product with that kind of penetration.

WeChat, which is the most popular mobile messaging app in China, couldn’t reach one billion active users even if it was used by every single person with a smartphone in China. That’s why the app “only” has 650 million active users right now.

Meanwhile, names such as Reddit, Twitter, Pinterest, and Instagram all boast hundreds of millions of users. However, none of these are able to yet have the global market penetration to reach the coveted billion mark.

The Big Three

So far, the only companies in possession of apps or programs with more than one billion active users are Google, Facebook, and Microsoft.

Amazingly, Google alone has seven of them: Search, Gmail, Maps, YouTube, Android, Chrome, and Play. The last of these to reach the one billion mark was Gmail, as per Alphabet’s announcement earlier this month during an earnings call.

Google also has the app that reached one billion users the quickest: Android did it in only 5.8 years.

Facebook also has three apps that can make the billion user claim. Facebook itself has the largest audience out of all of these apps, with 1.59 billion monthly active users. WhatsApp, which Facebook bought for $22 billion in October 2014, has also recently announced on its blog that it also surpassed the one billion user mark. This now fulfills a promise that Mark Zuckerberg made to Facebook shareholders at the deal’s outset.

Lastly, there’s Microsoft’s Windows and Office products, which are the only paid products that could crack the list. They took the longest to get there: 25.8 years and 21.7 years respectively.

Ecommerce

Ranked: The World’s Most Used Ecommerce Apps

Asian platforms dominate global rankings.

Published

1 week ago

on

December 24, 2025

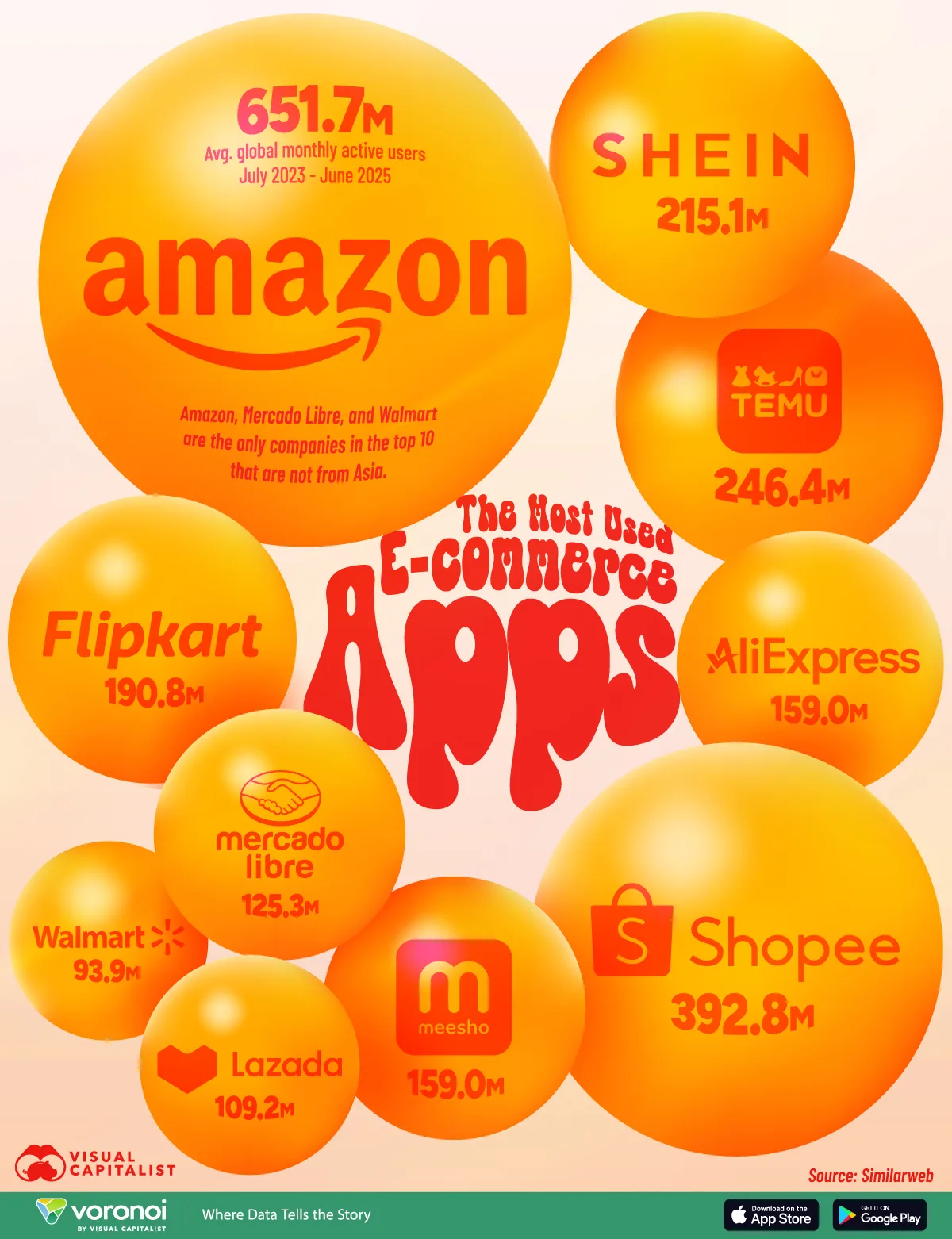

Ranked: The World’s Most Used Ecommerce Apps

See visuals like this from many other data creators on our Voronoi app. Download it for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

- Amazon remains the world’s most popular ecommerce app, with over 650 million monthly active users.

- Asian platforms dominate global rankings, accounting for seven of the top 10 ecommerce apps.

Mobile apps have become the primary gateway to online shopping for hundreds of millions of consumers worldwide. From everyday essentials to fast fashion and electronics, ecommerce apps now shape how people browse, compare, and buy products across borders.

This visualization ranks the world’s most popular ecommerce apps in 2025 based on average monthly active users (MAUs). The data for this visualization comes from Similarweb.

Together, the top 10 apps reach well over two billion users each month.

Amazon’s Global Lead

Amazon ranks first by a wide margin, with an average of 651.7 million monthly active users. Its dominance reflects a broad product selection, deep logistics infrastructure, and strong brand recognition across North America, Europe, and parts of Asia.

Notably, Amazon is one of only three companies in the top 10 that are not based in Asia.

Asia’s Ecommerce Powerhouses

Asian platforms account for seven of the top 10 apps, led by Shopee (392.8 million MAUs), Temu (246.4 million), and Shein (215.1 million). These companies have grown rapidly by combining mobile-first design, aggressive pricing, and highly localized offerings.

India and Southeast Asia are also well represented. Flipkart (190.8 million) and Meesho (159 million) reflect India’s fast-growing digital consumer base, while Singapore’s Lazada (109.2 million) continues to serve multiple Southeast Asian markets through a single app ecosystem.

| App | Country | Monthly Users |

|---|---|---|

| Amazon | 🇺🇸 United States | 651.7M |

| Shopee | 🇸🇬 Singapore | 392.8M |

| Temu | 🇨🇳 China | 246.4M |

| Shein | 🇨🇳 China | 215.1M |

| Flipkart | 🇮🇳 India | 190.8M |

| AliExpress | 🇨🇳 China | 159M |

| Meesho | 🇮🇳 India | 159M |

| Mercado Libre | 🇦🇷 Argentina | 125.3M |

| Lazada | 🇸🇬 Singapore | 109.2M |

| Walmart | 🇺🇸 United States | 93.9M |

Regional Champions Outside Asia

Beyond Amazon, two other non-Asian platforms appear in the top 10. Mercado Libre ranks eighth with 125.3 million monthly active users, reflecting its dominant position across Latin America. Walmart rounds out the list at 93.9 million MAUs, supported by its strong U.S. retail footprint.

Learn More on the Voronoi App

If you enjoyed today’s post, check out ChatGPT Climbs to #10 in U.S. Web Traffic on Voronoi, the new app from Visual Capitalist.

Technology

Ranked: The Online Marketplaces Getting AI Traffic

Amazon captures almost half of all AI-referred visits.

Published

1 week ago

on

December 23, 2025

The Online Marketplaces Getting AI Traffic

See visuals like this from many other data creators on our Voronoi app. Download it for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

- Amazon dominates AI-driven referral traffic, capturing nearly half of all visits sent by AI tools.

- Large, established marketplaces benefit most from AI referrals, while smaller platforms capture only marginal shares.

Online shopping is increasingly shaped by artificial intelligence. From product discovery to price comparison, AI tools are now acting as intermediaries between consumers and digital storefronts.

This visualization shows which online marketplaces are receiving the most referral traffic from AI sources and how concentrated this traffic is among a handful of major players.

The data for this visualization comes from Similarweb. It tracks AI-generated referral traffic between July 2024 and June 2025, measuring both share of referrals and total visit volumes.

Amazon’s Outsized Lead

Across all platforms, AI tools drove an estimated 25.9 million referrals over the 12-month period.

Amazon stands far ahead of every other marketplace. The platform captured 46% of all AI-driven marketplace traffic, totaling roughly 11.9 million visits. This dominance reflects Amazon’s massive product catalog, strong brand recognition, and deep integration into search and recommendation ecosystems.

AI tools tend to surface comprehensive, reliable results, which favors platforms with Amazon’s scale.

Big-Box Retailers and Marketplaces Follow

Behind Amazon, Walmart secured 12% of AI referrals, or about 3.1 million visits. Etsy followed closely with 11%, reflecting strong AI interest in niche goods. eBay rounded out the top tier with 9% of referrals.

Traditional retailers like Target and Wayfair each captured around 6% of AI traffic.

| Marketplace | Share of AI Referrals | Number of AI Referrals |

|---|---|---|

| amazon.com | 46% | 11.9M |

| walmart.com | 12% | 3.1M |

| etsy.com | 11% | 2.9M |

| ebay.com | 9% | 2.4M |

| target.com | 6% | 1.6M |

| wayfair.com | 6% | 1.5M |

| costco.com | 2% | 426.1K |

| samsclub.com | 1% | 292.3K |

| temu.com | 1% | 288.7K |

| zazzle.com | 1% | 285.2K |

| Other marketplaces | 5% | 1.23M |

| Total | 100% | 25.9M |

Smaller Platforms

Beyond the top six marketplaces, AI traffic drops off sharply. Costco, Sam’s Club, Temu, and Zazzle each received between 1% and 2% of referrals, amounting to a few hundred thousand visits apiece. Collectively, all other marketplaces accounted for just 5% of AI-driven traffic.

Learn More on the Voronoi App

If you enjoyed today’s post, check out Ranked: The Top Factors That Build AI Trust on Voronoi, the new app from Visual Capitalist.